Article by: ETO Markets

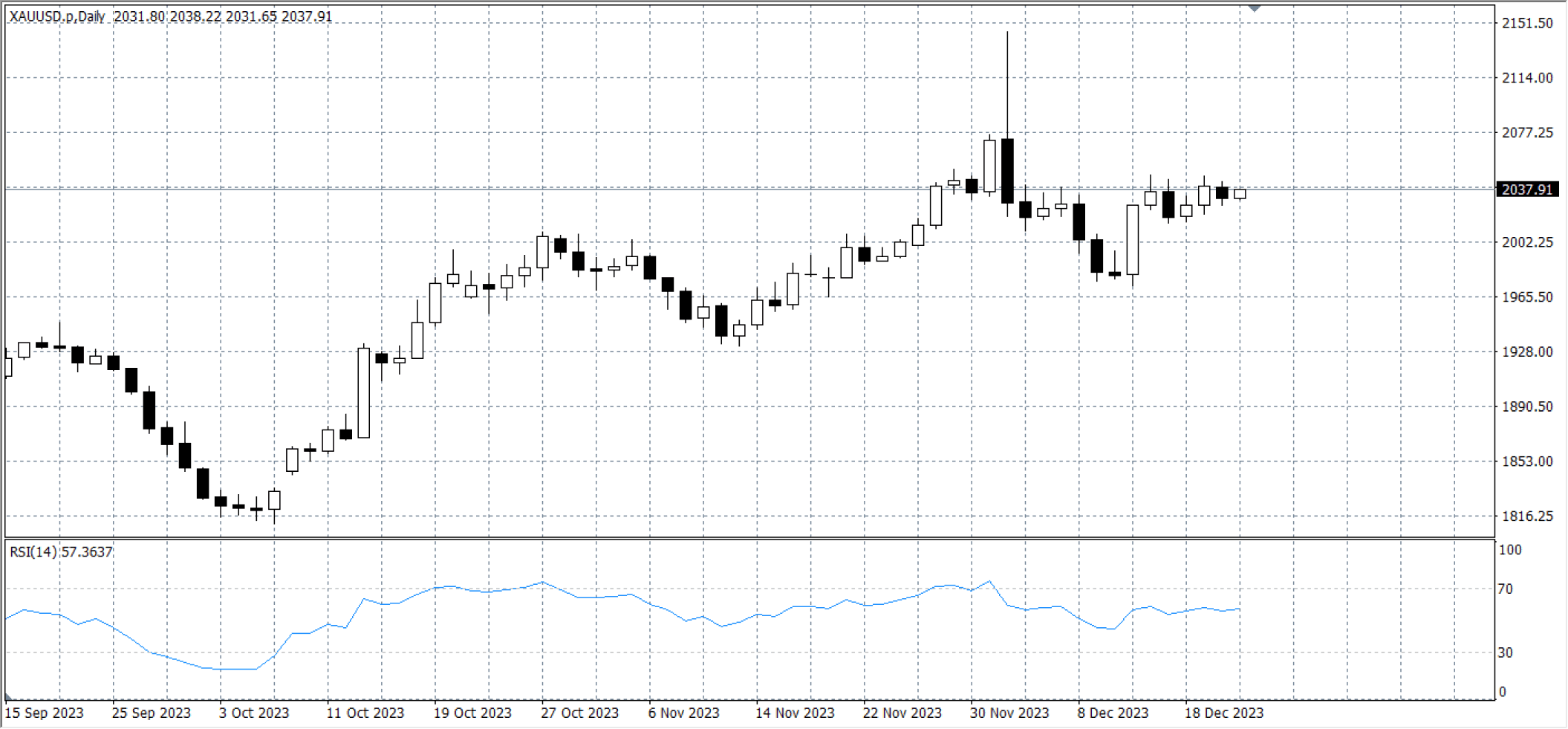

Gold prices saw a slight dip today, staying within Tuesday's trading range. The US Dollar gained strength in the morning, supported further by positive US data released after Wall Street's opening. CB Consumer Confidence for December improved to 110.7, surpassing the forecast of 104.6. As a result, XAU/USD declined from its intraday high of $2,043.57 to around $2,029.46.

Later in the European morning, optimism returned to financial markets as the UK reported a further easing of inflation in November. The Consumer Price Index (CPI) dropped by 0.2% MoM but increased by 3.9% YoY, below the expected 4.4% rise. On Tuesday, Canada's November annual CPI held steady at 3.1%, slightly exceeding the forecast of 2.9%.

Traders are now anticipating the release of the US Personal Consumption Expenditures (PCE) Price Index on Friday, a key inflation indicator for the Federal Reserve (FED). Market reactions could be significant, potentially confirming or challenging the Fed's recent shift in monetary policy