Article by: ETO Markets

Gold (XAU/USD) pulls back from its record high near $… amid profit-taking, though its broader uptrend remains intact. Market sentiment remains bullish due to geopolitical risks, concerns over Trump’s tariffs, and expectations of rising inflation. Fears of a global trade war, triggered by Trump's 25% tariffs on steel and aluminum and additional levies on Chinese imports, continue to drive demand for the safe-haven metal. Meanwhile, a weaker US Dollar, lingering doubts over US consumer health, and uncertainty surrounding Federal Reserve policy further support gold prices. Despite recent gains, Fed officials remain cautious, with mixed signals on potential rate cuts. St. Louis Fed President Musalem warned of inflation risks, while Atlanta Fed President Bostic signaled room for two rate cuts this year, contingent on economic conditions. Traders now look to upcoming global PMI data and US economic reports, including Existing Home Sales and the Michigan Consumer Sentiment Index, for fresh market direction. While gold faces some near-term resistance, underlying factors such as geopolitical tensions and economic uncertainty suggest continued strength, positioning the metal for its eighth consecutive weekly gain.

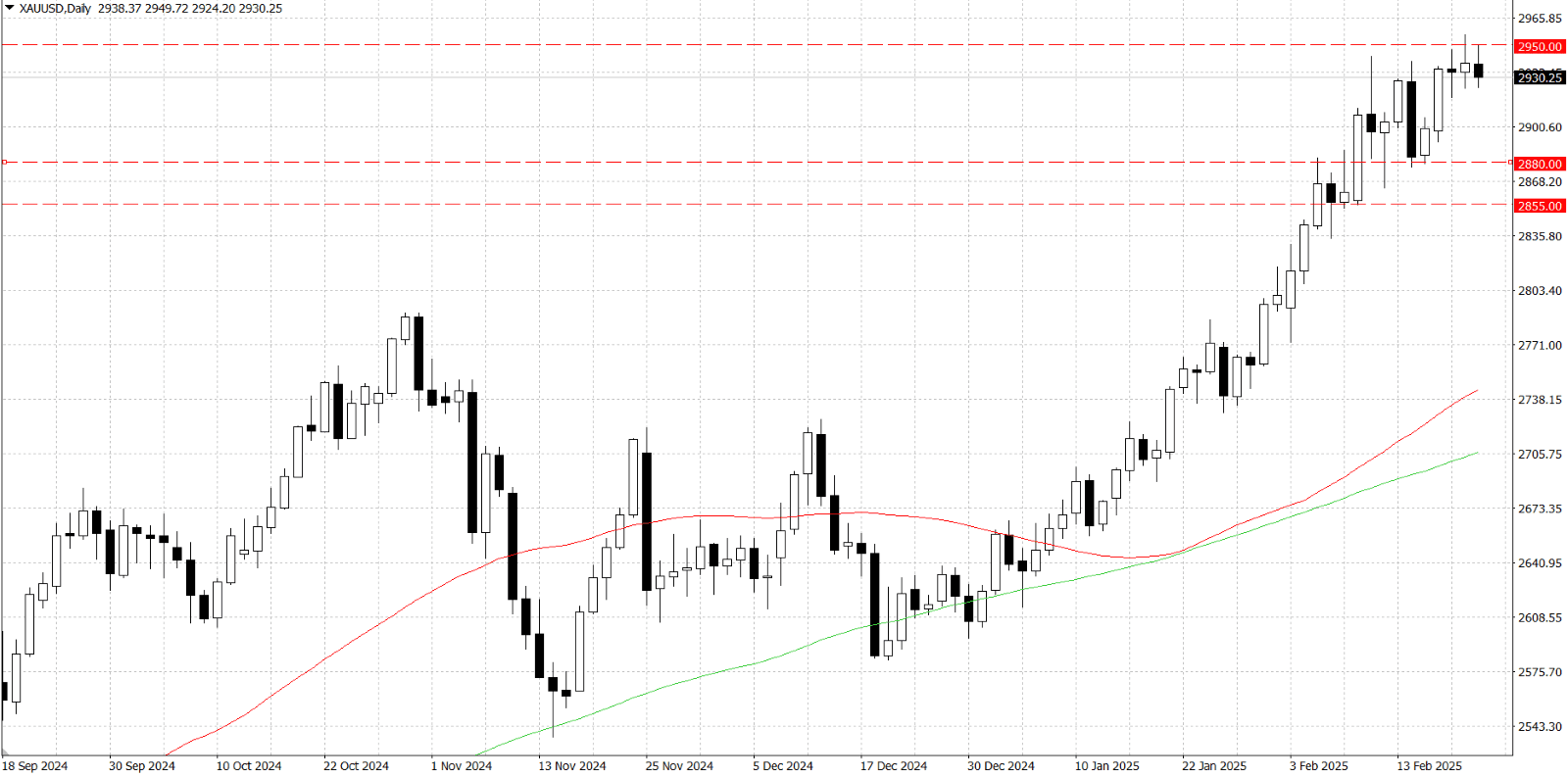

From a technical perspective, gold's (XAU/USD) technical outlook remains bullish despite RSI nearing overbought levels at 70, warranting caution. The breakout above the $…–… range signals further upside potential, with immediate resistance at $…–…. A sustained move beyond this zone could reinforce bullish momentum. On the downside, $… serves as initial support, followed by $…. A breach below $… may accelerate declines toward $…–…, with further downside at $… and $…. Traders may await consolidation and follow-through buying before initiating fresh long positions, as the broader uptrend remains intact.