Article by: ETO Markets

Gold prices (XAU/USD) consolidated their strong gains from yesterday during Friday's Asian session, hitting a new two-week high at $2365. On Thursday, the US initial jobless claims rose to 238K, higher than the expected 235K, further confirming the weakness of the US economy. Additionally, the Bank of England's (BoE) dovish outlook boosted bets on an August rate cut, while the Swiss National Bank (SNB) unexpectedly implemented its second rate cut of 2024, which also supported precious metal prices.

The CME FedWatch tool shows a 58% probability of a 25-basis point rate cut in September, down from 62% the previous day. Additionally, despite weak US data, US Treasury yields rose on Thursday due to expectations of new supply next week, pushing the dollar to a weekly high. This led to the unusual simultaneous rise in both the US dollar index and precious metal prices.

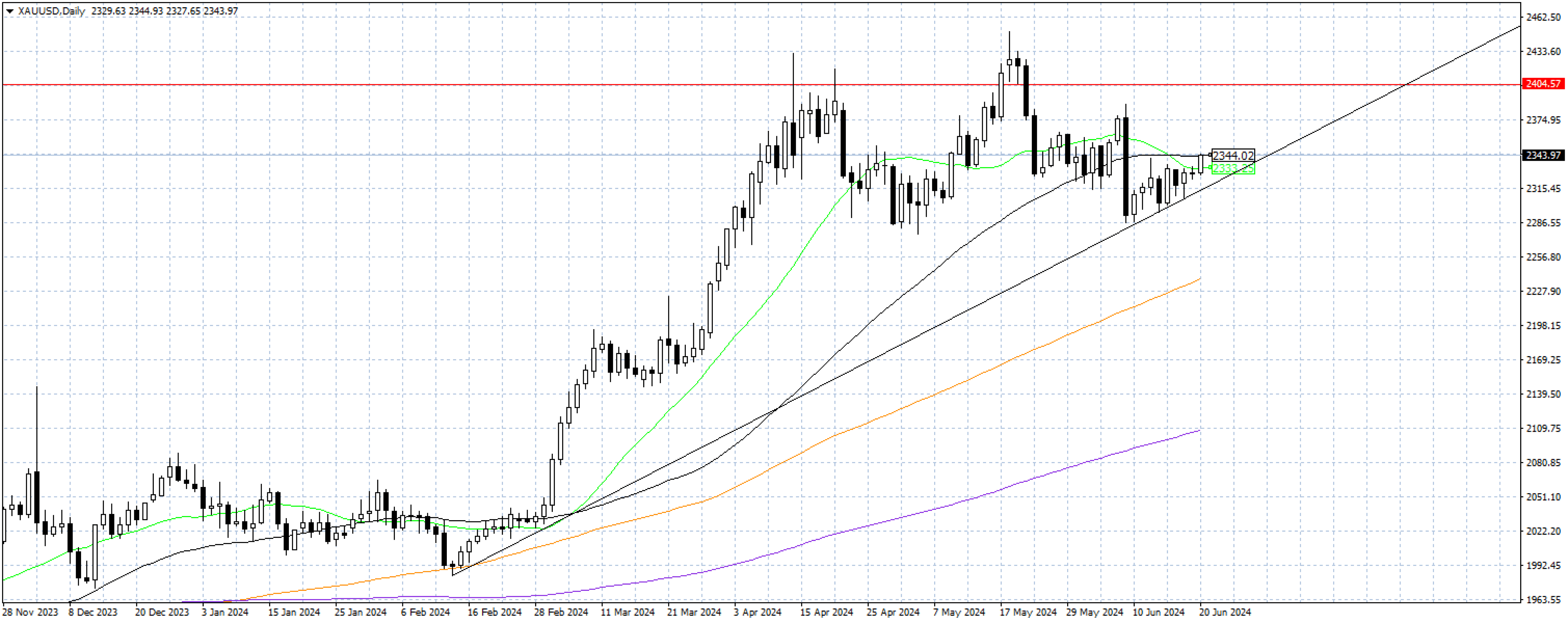

From a technical perspective, gold prices (XAU/USD) have broken above the 50-day simple moving average at $… , becoming a trigger for new bullish traders. It is now fully breaking the downtrend, aiming for the $… -$… range, and poised to move towards the $… level. The 20-day simple moving average at $… has turned into strong support, making it difficult for sellers to push prices below this level. Additionally, the Relative Strength Index (RSI) at 55 indicates that gold has substantial room for further gains and the potential to create new highs.