Article by: ETO Markets

Gold extended its retreat for a second day on Wednesday after failing to sustain a break above the $3,500 mark—its latest attempt at a fresh record—and slipped back toward the $3,300 area as safe-haven demand ebbed amid rising risk appetite. Optimism over a de-escalation in the US-China tariff dispute, fueled by upbeat commentary from Treasury Secretary Scott Bessent and White House spokeswoman Karoline Leavitt, alongside President Trump’s decision to abandon threats to dismiss Fed Chair Jerome Powell before his term ends in May 2026, bolstered equities and weighed on bullion. At the same time, the US dollar’s recovery from multi-year lows stalled on renewed concerns about the strength of the American economy and growing market expectations that the Federal Reserve will resume cutting rates as early as June—moves that, paradoxically, could eventually support non-yielding gold if confirmed. Geopolitical easing was further hinted at by Russian President Vladimir Putin’s positive remarks on peace initiatives and Ukrainian President Volodymyr Zelenskyy’s readiness to negotiate after a ceasefire, reinforcing risk-on sentiment. Looking ahead, traders will be watching global flash PMIs and further trade-policy developments for fresh cues on economic health and the balance of safe-haven versus risk assets.

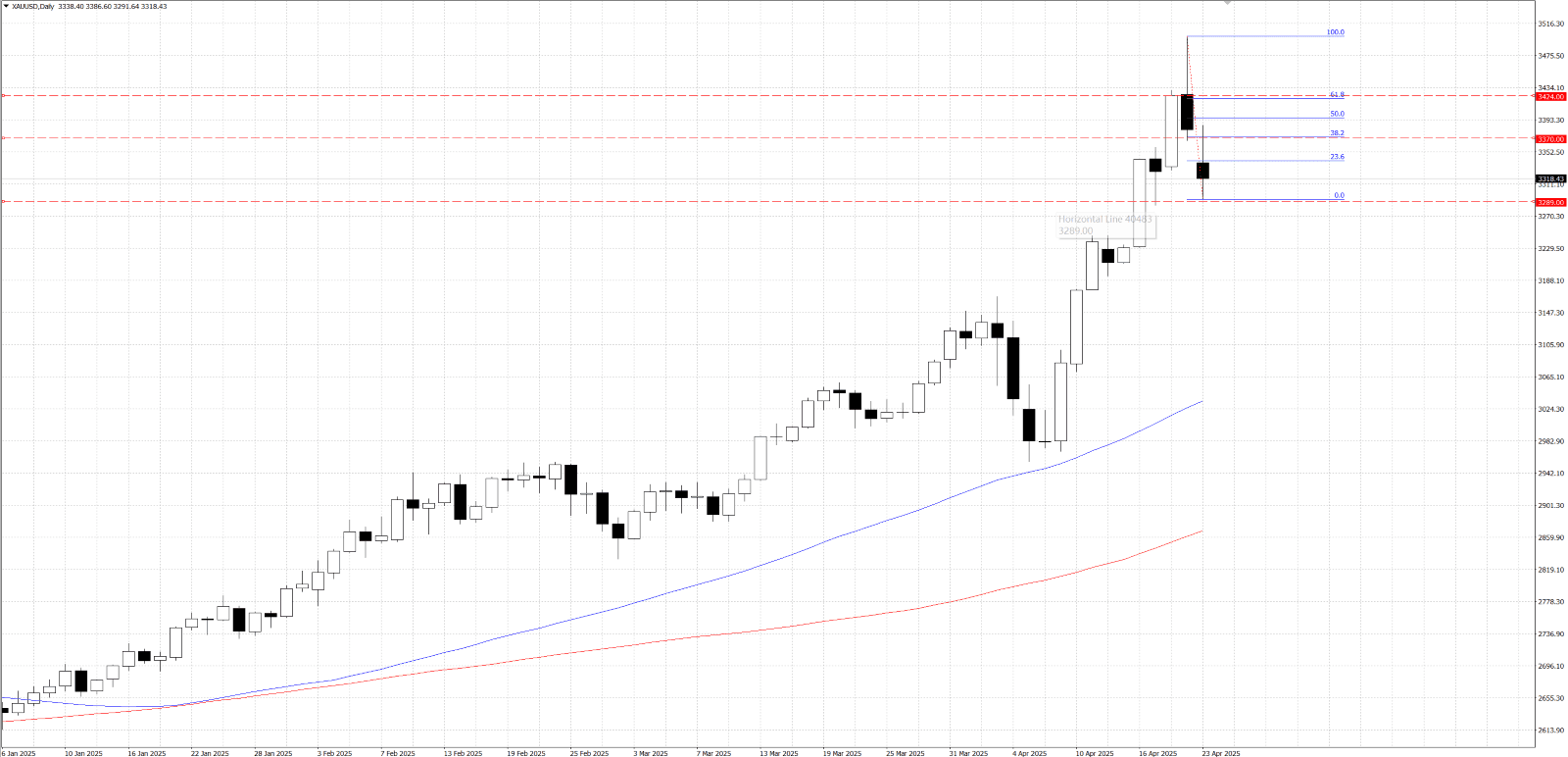

From a technical perspective, gold’s failure to reclaim the 23.6% Fibonacci retracement of its recent rally—from the mid-$… monthly swing low—suggests the first hints of bullish exhaustion as intraday buying stalls, leaving the metal vulnerable to further declines. Still, momentum indicators on the daily chart remain firmly in positive territory, cautioning against aggressive short positions. In the near term, any break below this morning’s Asian low near $… should encounter solid support around the 38.2% Fib level at roughly $…, with a decisive breach below that level likely opening the door to a more pronounced corrective slide. Conversely, on the upside the $… area (the 23.6% Fib level) stands as the first barrier ahead of $…; a sustained move above could target the horizontal resistance zone at $…–…, and ultimately set bulls up for another run toward the $…psychological mark and the extension of the four-month uptrend.