Article by: ETO Markets

The gold market is navigating a complex fundamental landscape as we approach year-end 2024, with prices responding to multiple significant catalysts. The Federal Reserve's recent monetary policy decision, marking the third consecutive rate cut, has established a delicate balance in market dynamics. This policy shift, coupled with President-elect Trump's proposed tariff plans, has intensified market uncertainty, driving safe-haven demand. The geopolitical landscape, particularly the ongoing Russia-Ukraine conflict and Middle Eastern tensions, continues to provide underlying support for gold prices. However, the market faces headwinds from the Fed's cautious approach to future rate cuts, as inflation remains sticky above the 2% target. The recent uptick in US Treasury yields and corresponding dollar strength have created technical resistance levels, particularly evident in the declining volume patterns observed during recent rally attempts.

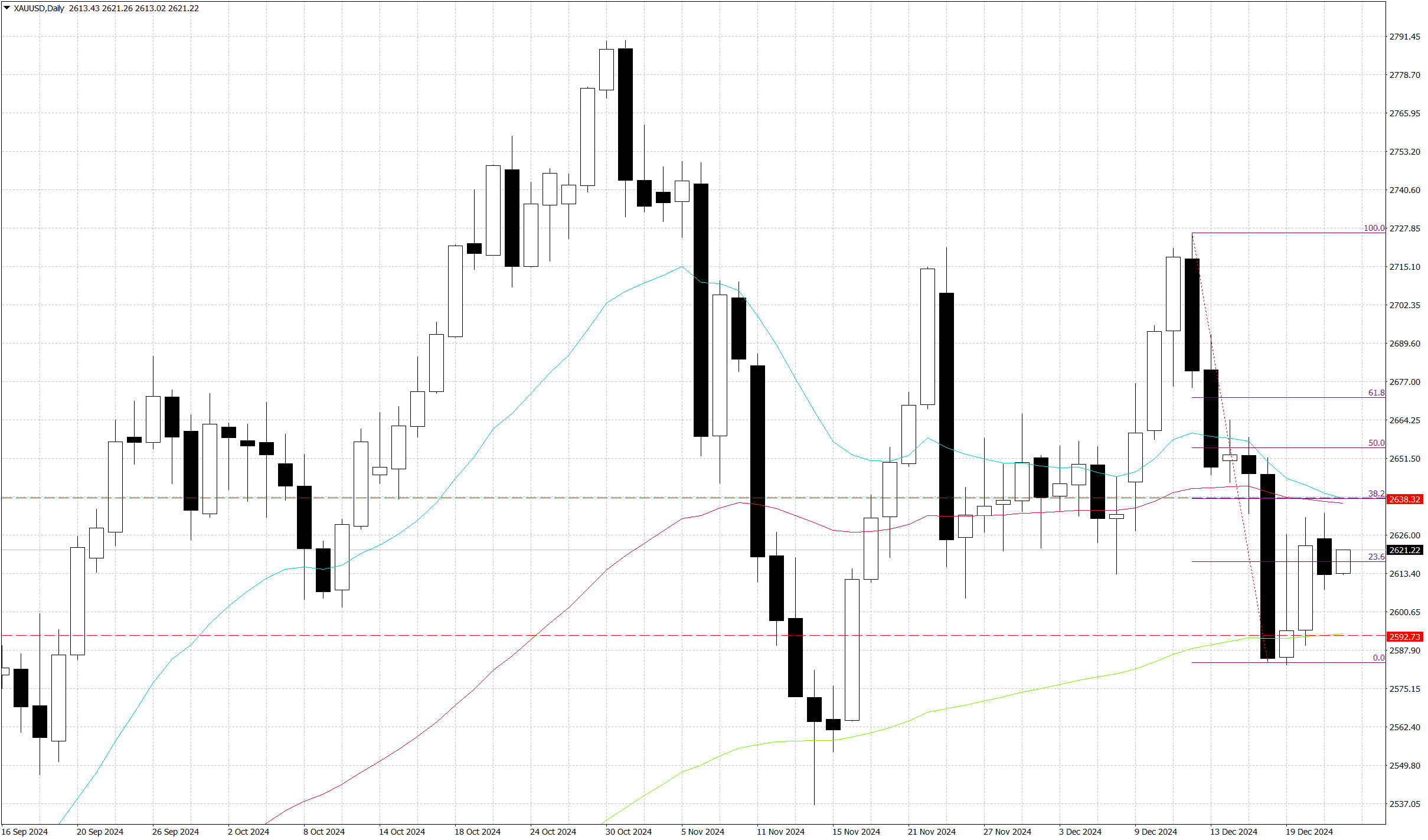

The technical framework reveals a multi-layered support and resistance structure. The primary support zone centres around the 100-day Exponential Moving Average at $..., with secondary support at the monthly low of $..., where significant buying interest has emerged. The final support level sits at $..., coinciding with the mid-November swing low. On the upside, immediate resistance stands at $..., with further barriers at $... (61.8% Fibonacci retracement) and $... (previous high). On the upside, immediate resistance stands at the 20-day Exponential Moving Average of $..., reinforced by the 38.2% Fibonacci retracement level. A successful breach could target the secondary resistance at $... (61.8% Fibonacci retracement), with final resistance at $... (previous high). The Average Directional Index reading of ... suggests decreasing trend strength, while volume profile analysis shows major liquidity nodes at each support level, particularly around $.... Momentum indicators, with the Positive Directional Indicator at ... versus Negative Directional Indicator at ..., suggest sustained bearish pressure, though this could quickly reverse on a break above the primary resistance.