Article by: ETO Markets

Gold prices have held steady above the $3,000 psychological level for a second consecutive day amid mounting uncertainty over U.S. President Donald Trump's planned reciprocal tariffs set for next week, which have bolstered safe-haven demand. This sentiment is reinforced by disappointing U.S. macro data that has weakened the dollar, while growing expectations of an imminent Federal Reserve rate-cutting cycle—prompted by recession fears—add further support to non-yielding gold. Although traders are cautious, awaiting the U.S. Personal Consumption Expenditure Price Index and upcoming U.S. Durable Goods Orders for clearer direction, the broader backdrop of easing inflation concerns, a dovish Fed outlook with potential rate cuts later this year, and lingering trade jitters suggests that the overall momentum remains tilted to the upside, even as a generally positive risk sentiment tempers aggressive positioning.

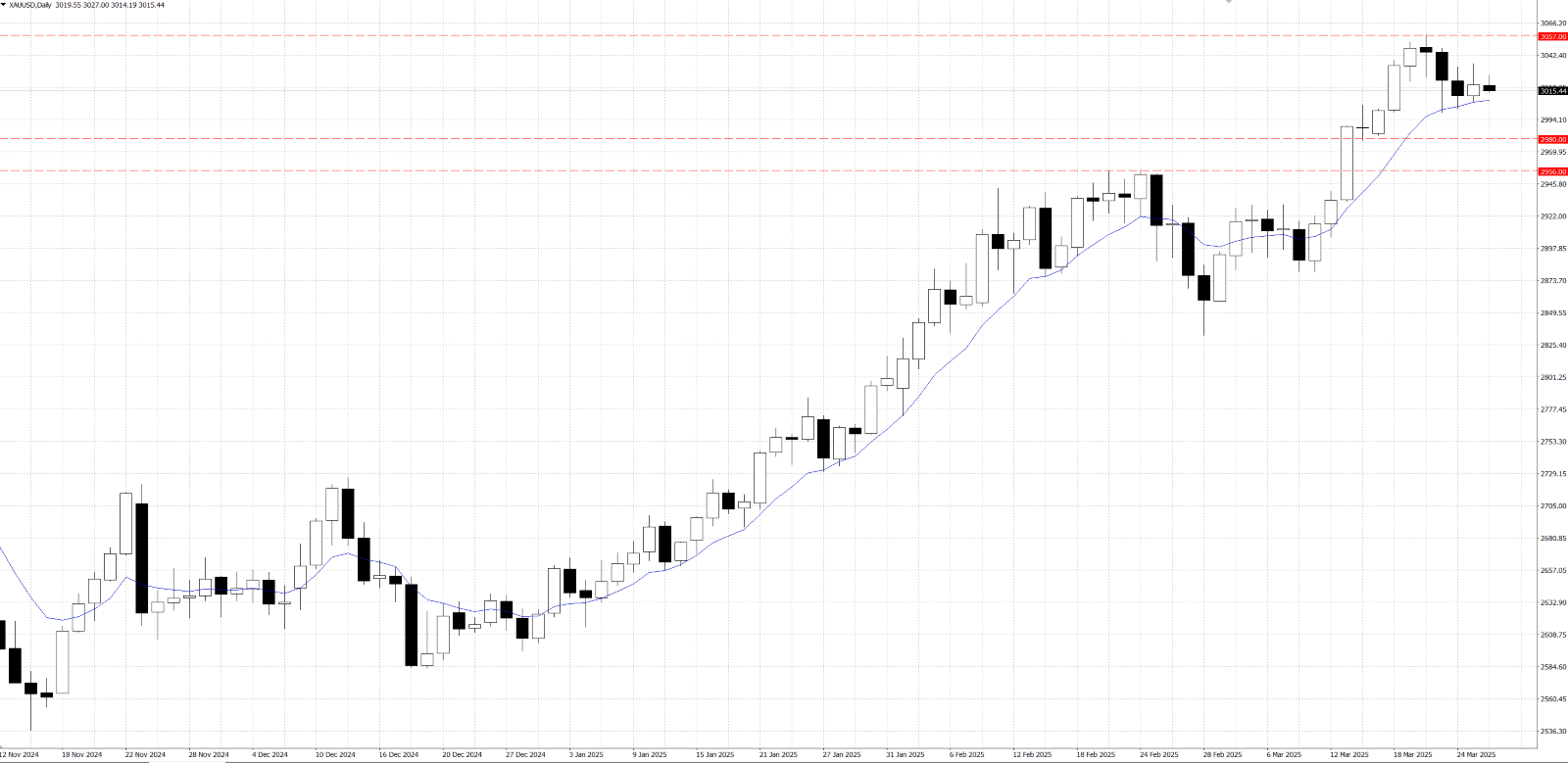

From a technical standpoint, the bullish resilience observed near the $… level suggests that gold's momentum is set to continue upward. If follow-through buying occurs beyond the overnight swing high of around $…, it would reinforce the bullish outlook and could drive the XAU/USD pair toward its all-time peak range of approximately $…-…, as witnessed last week. Conversely, the $… mark remains a crucial support level; a decisive break below this point may trigger technical selling, potentially pulling prices down to the $…-… range, with the possibility of further decline toward the next support zone around the $…-… area.