Article by: ETO Markets

Gold prices have continued to rise on the back of geopolitical tensions and expectations of a Fed rate cut, and are nearing record highs. The Fed is widely expected to cut interest rates by a further 50 basis points in November, a dovish expectation that has undermined the dollar's rally and provided solid support for gold. At the same time, rising tensions in the Middle East have further boosted safe-haven flows into the gold market. In addition, despite China's announcement of a series of new policies to stimulate the economy, concerns about its recovery prospects remain, which also provides support for gold prices.

However, investors are on the sidelines ahead of an upcoming speech by Federal Reserve Chairman Jerome Powell, looking for fresh clues on the future path of interest rate cuts. In addition, key U.S. economic data, such as the final reading of second-quarter GDP, weekly jobless claims and durable goods orders, will also have some impact on market sentiment. If the data is stronger than expected, it could boost demand for the dollar in the short term, which in turn could put downward pressure on gold prices.

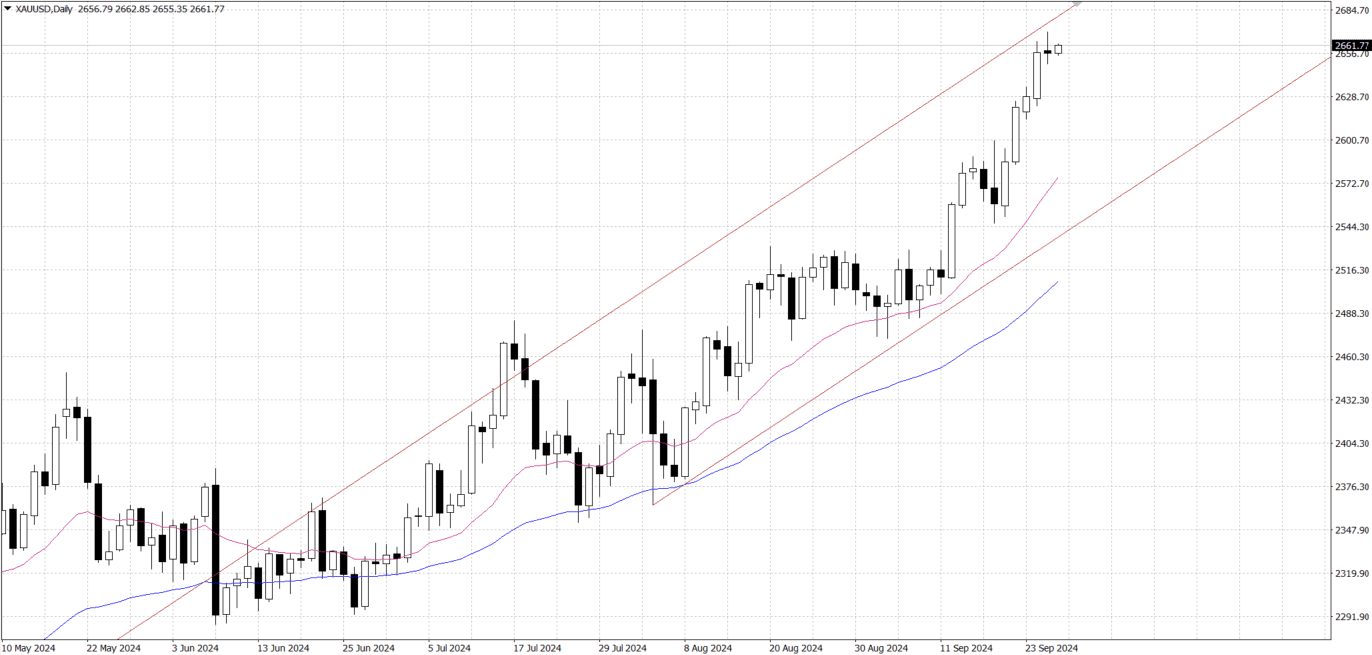

From a technical point of view, gold has seen a degree of consolidation following its record high, and the Relative Strength Index (RSI) on the daily chart shows that gold is overbought, indicating that some profit-taking may be in the offing. However, the gold price remains in the upward channel, indicating that its overall trend remains bullish. A break in the short-term uptrend channel supports expectations of further gains, suggesting that the path of least resistance for gold remains to the upside.

In the current situation, if gold prices fall to the upward channel resistance level near $…, it can be seen as a buying opportunity, with support near $…. A break below $… could trigger some technical selling down to the $… area and possibly even a pullback to the $… area and support between $…-…. As a result, in the short term, gold prices are likely to wait for fresh momentum in a consolidation phase to drive further gains.