Article by: ETO Markets

The price of gold shows strength versus the US dollar due to expectations that the Federal Reserve will eventually lower interest rates. But, given that Fed policymakers favor keeping interest rates higher for longer in order to put downward pressure on sticky inflation, the precious metal's upside seems limited. Investments in non-yielding assets, like gold, increase when investors think the Fed will eventually start to loosen its tight monetary policy.

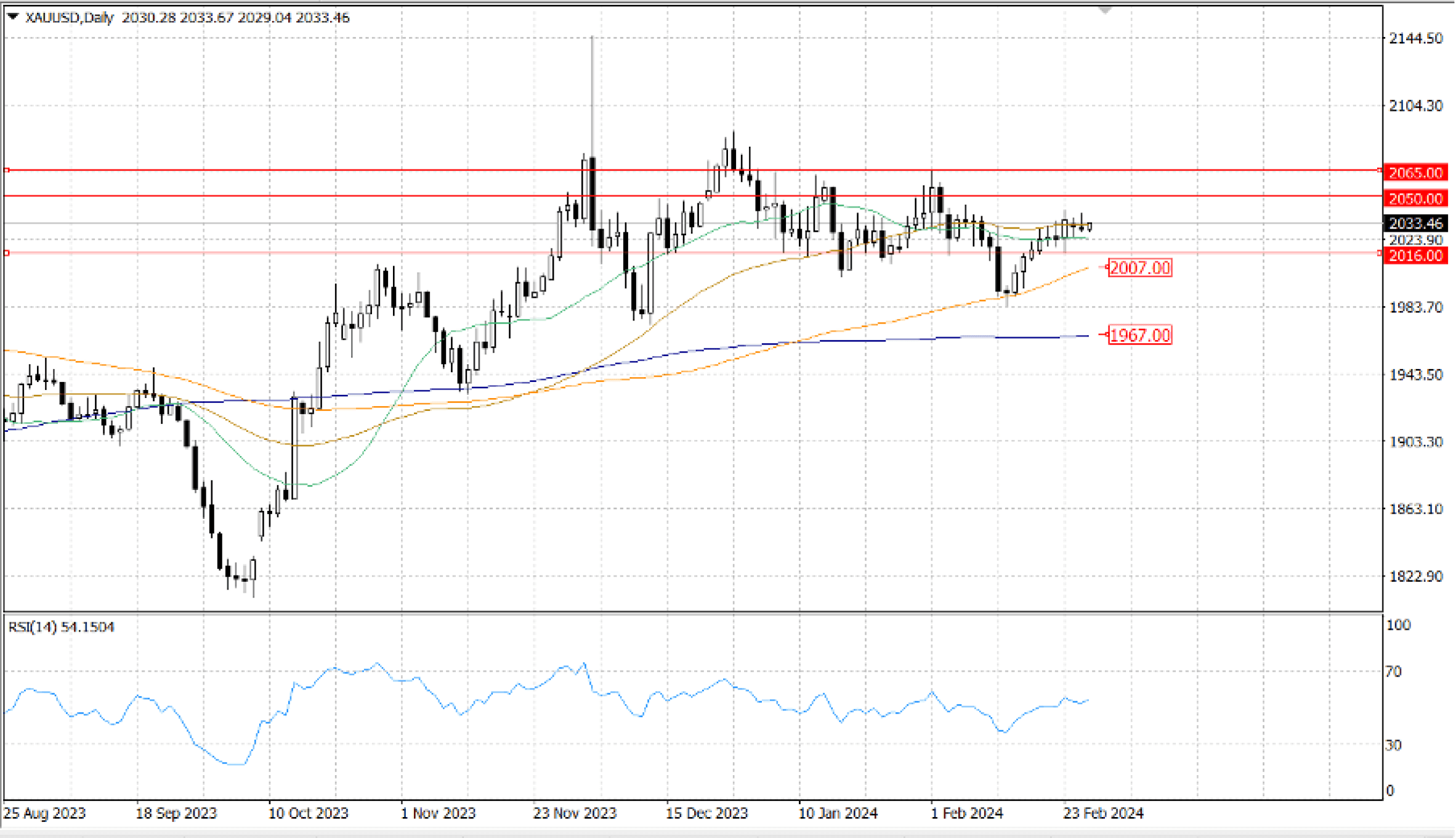

As XAU/USD has been unable to break above the psychological resistance level of $… for the past 12 days, gold is currently trading sideways. Though the upward tilt is still present, buyers may be able to challenge the psychological $… level if they manage to regain the $… level. The next significant resistance levels are the high of February 1 at $...

Conversely, should gold drop below the $… swing low from February 16, XAU/USD will plunge into the $… level. Important technical support levels such as the 100-DMA at $… and the 200-DMA at $… will become visible once that is cleared.