Article by: ETO Markets

Gold prices navigate a complex macro environment driven by key factors affecting market sentiment and trading dynamics. Geopolitical tensions in the Middle East and the Russia-Ukraine conflict continue to support safe-haven demand, while the upcoming Trump administration's potential trade policies have heightened market uncertainty, particularly regarding future tariff implementations. However, the Federal Reserve's increasingly hawkish stance regarding 2025 rate cuts creates significant headwinds for the non-yielding metal, as progress in lowering inflation to the 2% target has stalled. This monetary policy outlook has strengthened the US Dollar, limiting gold's upside potential despite geopolitical support. Year-end position adjustments and lighter holiday trading volumes suggest continued market volatility as traders balance these competing influences ahead of the January transition period.

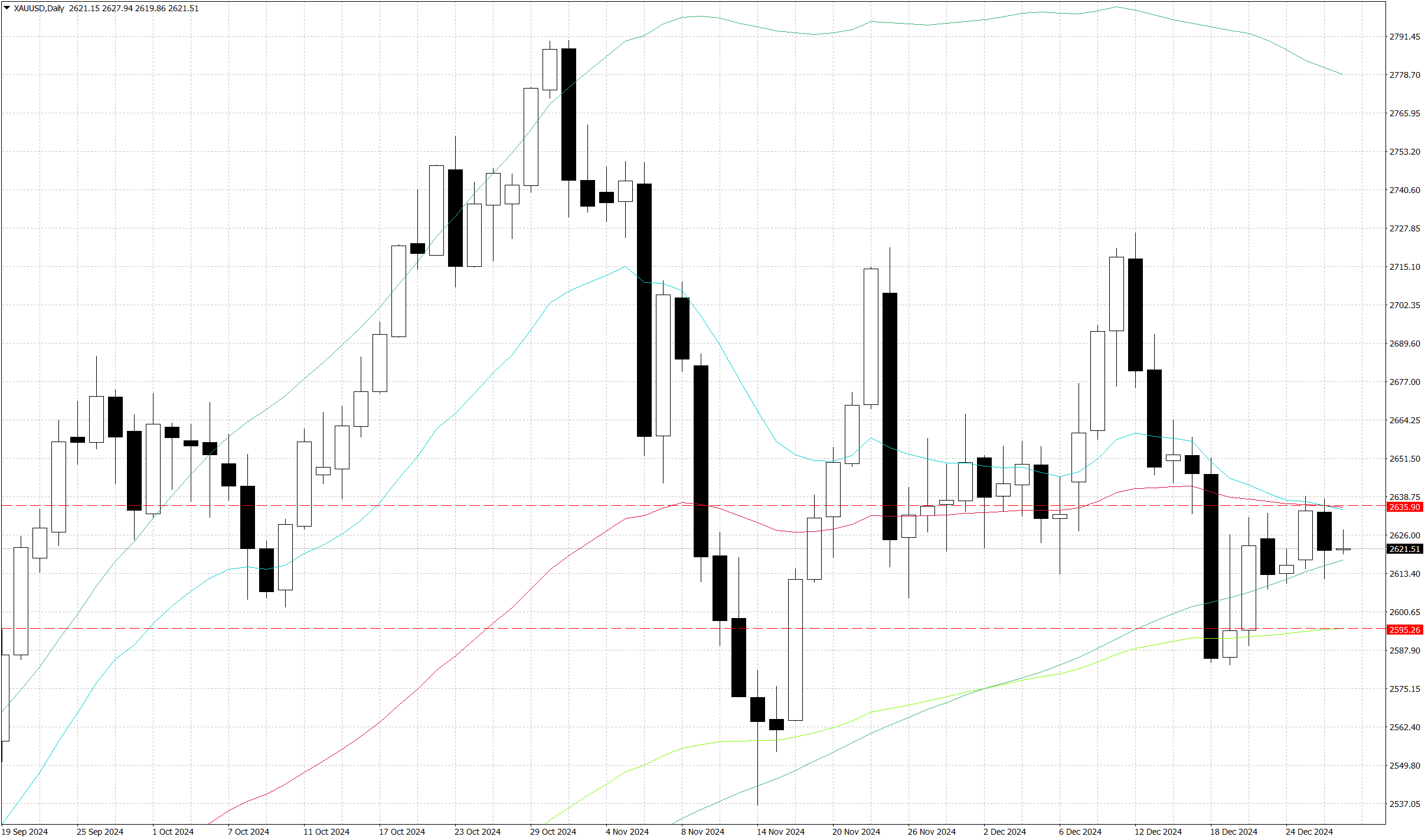

The daily chart shows a defined consolidation phase with clear technical boundaries. Primary support at $…, marked by the 100-day Exponential Moving Average, provides the foundation for current price action, with significant volume profile confirmation. Secondary support rests at $… (monthly low), creating a crucial floor for near-term trading. The resistance structure presents multiple barriers: immediate resistance at $… coincides with Moving Average convergence, followed by a key technical zone at $…-$… supported by Fibonacci retracement (61.8%) and volume profile confluence. The psychological level at $… represents major resistance, while the monthly high at $… caps the upside.