Article by: ETO Markets

Gold (XAU/USD) continues its bullish momentum, currently trading near $…, marking another significant all-time high (ATH). This rally aligns with easing U.S. Treasury yields and growing expectations that the Federal Reserve may pivot toward rate cuts at its November meeting. Meanwhile, traders are closely watching the uncertainty caused by the upcoming US election, which increases the demand of safe-haven assets. Additionally, mixed U.S. data, weak September JOLTS figures and rising consumer confidence, has also added to market uncertainty. Gold’s ascent is also fuelled by geopolitical tensions, with conflicts in the Middle East, Ukraine, and reports of North Korean troops in Russia contributing to safe-haven demand. With key economic data ahead, including the ADP Employment Report, Nonfarm Payrolls, and Q3 Gross Domestic Product (GDP), market participants remain focused on further developments that could influence the Fed’s policy stance.

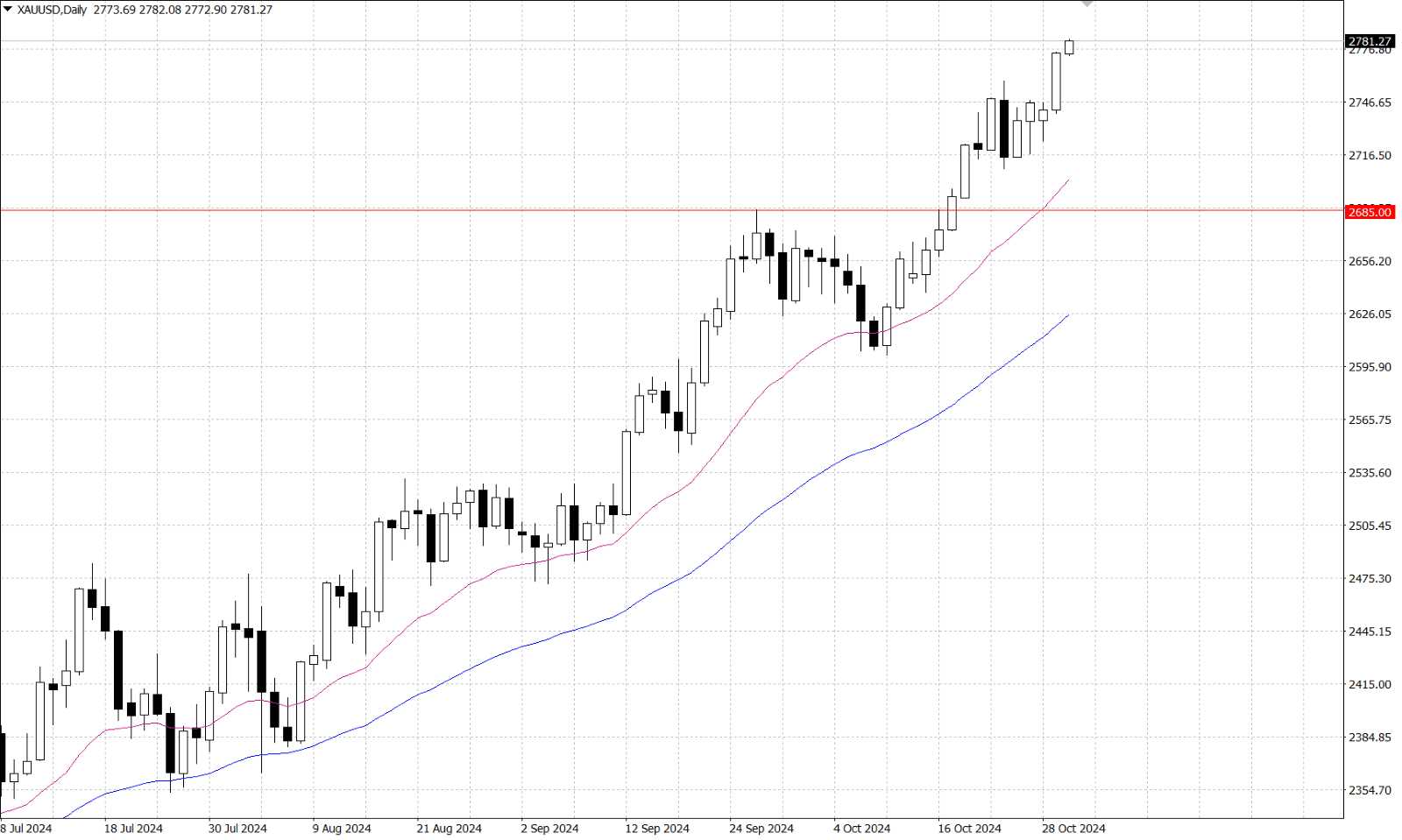

From a technical standpoint, XAU/USD needs to decisively break above the $…, resistance to fuel further bullish momentum. A successful breakout could push prices toward the psychological $… level, extending the rally beyond the recent highs. However, with gold trading near the upper band of the four-month uptrend, a brief consolidation or minor pullback toward the $…-$… support zone may offer healthier conditions for bulls. If the price slips below $…, it could trigger technical selling, with further downside targets near $… (September high). Bulls should remain cautious given the extended rally and watch for corrective moves before positioning for additional upside.