Article by: ETO Markets

On Wednesday, the U.S. Bureau of Labor Statistics (BLS) reported that the annual CPI decreased from 3.4% to 3.3%, falling short of expectations for it to remain unchanged. The annual core Consumer Price Index (CPI), which excludes the more volatile food and energy prices, rose by 0.2% in the reporting month, also below the anticipated 0.3%. The continued weak economic data from the U.S. led to a surge in the stock market, while the U.S. Dollar Index (which measures the dollar against a basket of major currencies) fell from 105 to 104. In contrast, the prices of precious metals such as gold and silver saw a rebound.

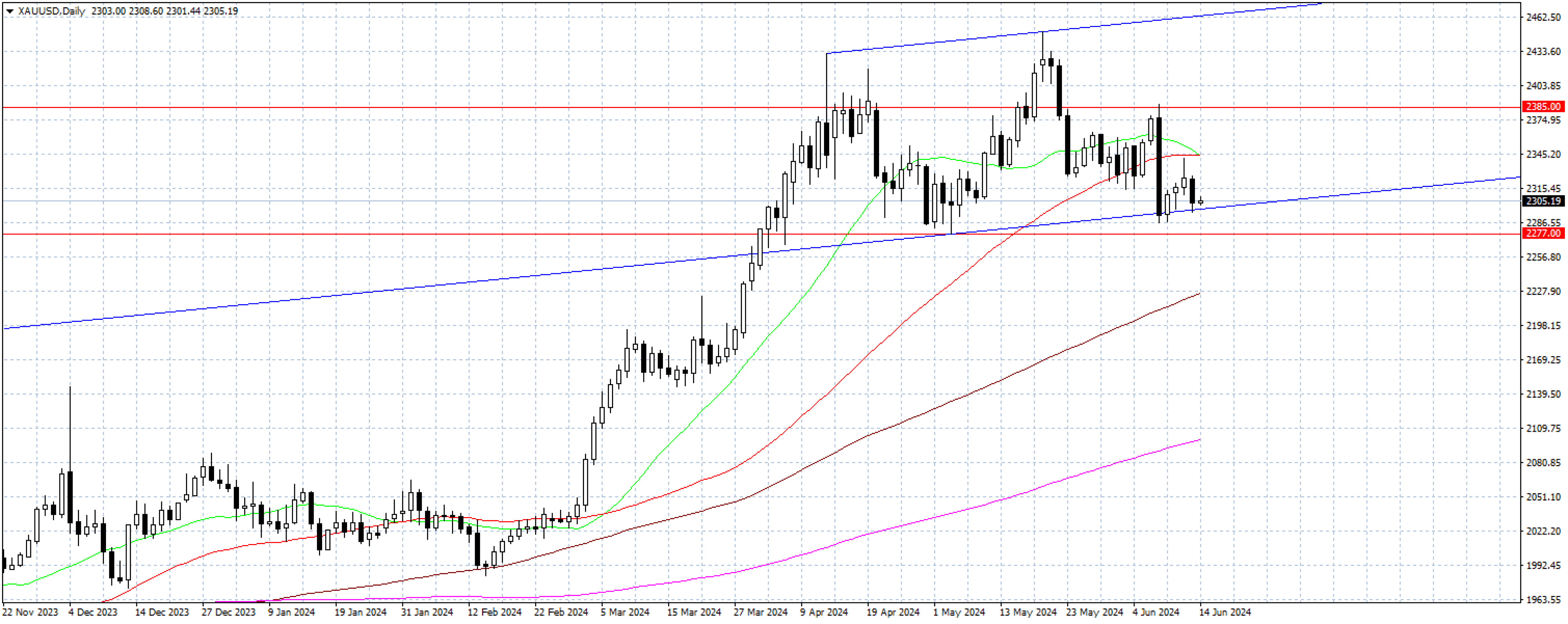

However, unexpectedly hawkish comments from the Federal Reserve put pressure on gold prices. Policymakers had initially planned for three rate cuts in March but now anticipate only one rate cut in 2024. This shift is seen as a key factor driving funds out of gold. Despite the continued uncertainties due to geopolitical tensions, gold prices have continued their decline over the past two weeks.

Due to the Federal Reserve's hawkish comments, the Australian dollar did not gain support from strong employment data. Additionally, the widespread expectation that the Bank of Japan will maintain its current policy led to further depreciation of the yen. Following the European Central Bank's (ECB) rate cut announcement last week, the euro also temporarily halted its upward trend.

This Thursday, gold prices initially rose to an intraday high of $2326 under the influence of weak Producer Price Index (PPI) data, but later retreated. Considerations by the Federal Reserve (Fed) for interest rate cuts provided strong support for the U.S. dollar, prompting gold bulls to adopt a more cautious stance. Despite U.S. CPI reports indicating ongoing deflationary trends and other weak economic data reinforcing this view, Fed Chairman Jerome Powell expressed continued "confidence concerns" regarding progress on inflation.

On the daily chart, the head and shoulders pattern remain unchanged, indicating a neutral to bearish bias for gold prices. However, the failure to break below the $… level has provided an opportunity for gold buyers to regain momentum. Pushing the price above $… could attract more bullish sentiment, potentially testing the June 7th cycle high of $... Conversely, if gold sellers manage to break below the support at $…, as suggested by the head and shoulders pattern, their ultimate target would be around $...

West Texas Intermediate (WTI) crude oil prices were affected by an unexpected increase in U.S. inventories and a downward revision of the International Energy Agency (IEA) demand growth forecast. After reaching a two-week high of $79.41 on Wednesday, prices briefly fell below $78. The reduced expectations for Fed rate cuts may limit crude oil price gains, but geopolitical tensions could provide some support.

On the hourly chart, XTI/USD declined after reaching a peak of … , pressured by the resurgence of bearish momentum. The price found new support at the 200-hour simple moving average of $…, while the May high of $… currently acts as resistance.