Article by: ETO Markets

In this week, the U.S. dollar (USD) has still shown strength against major currencies, driven by positive economic indicators and the Federal Reserve's recent interest rate cut of 50 basis points. This cut was intended to support economic stability as a “soft landing” and maintain employment levels, leading to expectations of further gradual cuts in the future.

At the same time, the European economy is facing sluggish growth due to various challenges, including an energy crisis and post-pandemic recovery struggles. The European Central Bank (ECB) may consider cutting rates, potentially leading to a weaker euro.

In a move to support economic growth, China's central bank announced a 0.5 percentage point reduction in banks' reserve requirement ratios (RRR), effective September 27. This marks the second cut for the year, with indications of a possible further reduction of 0.25 to 0.50 percentage points later this year. The Finance Ministry emphasized its commitment to providing stronger support for the economy, mentioning that there remains significant capacity for the central government to increase debt and the fiscal deficit. However, no specific details regarding additional stimulus measures were provided

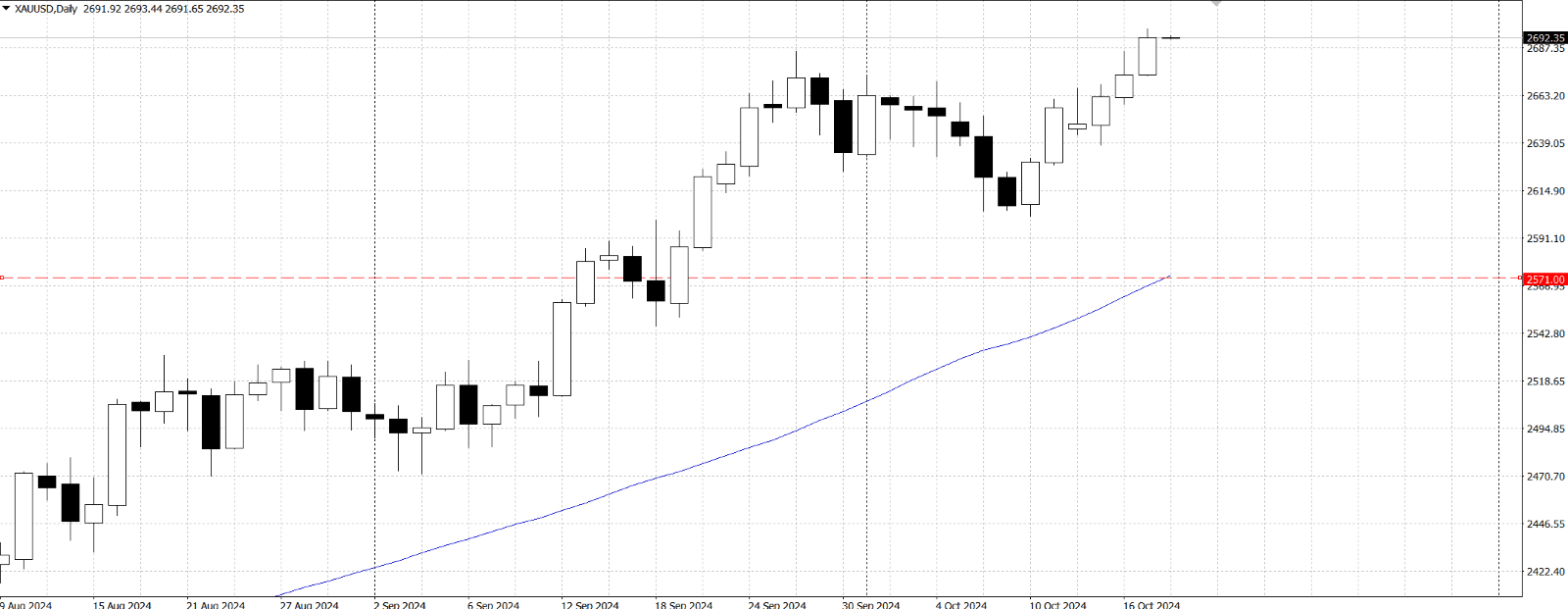

On Thursday, gold reached a record high but did not breach the $2,700 mark, held back by uncertainties surrounding the upcoming US elections. Despite positive US economic data, the precious metal remains resilient. September Retail Sales rose by 0.4% month-over-month, exceeding estimates of 0.3% and outperforming August’s 0.1% gain. Initial Jobless Claims for the week ending October 12 were 241K, below expectations and down from the previous week’s 258K, signalling a strong labour market, which initially pressured gold prices. The 10-year Treasury yield climbed by eight basis points to 4.096%, adding further weight on bullion. Geopolitical risks from the Middle East and uncertainty surrounding the contested US election are also fuelling demand for gold.

If the current upward trend continues, the XAU/USD could soon challenge the psychological $… mark, with further targets at $… and $…. However, if prices fall below $…, a retracement toward $2,650 and possibly $… is expected, with the 50-day Simple Moving Average at $…, acting as additional support.

During Thursday’s session, crude oil found stability after a four-day losing streak that left it down nearly 7% for the week. Traders are monitoring whether Israeli Prime Minister Benjamin Netanyahu will maintain his commitment to the US not to target Iranian oil installations, helping to form a floor in oil prices. Additional support came from the latest American Petroleum Institute (API) report, showing a surprise drawdown of 1.58 million barrels for the week ending October 11, against market expectations of a 2.3 million barrel build. This unexpected inventory drop signals steady demand, easing some downward pressure despite recent losses.

Meanwhile, the US Dollar Index (DXY) is preparing for a volatile session. The European Central Bank (ECB) announced a 25 bps rate cut, but ECB President Christine Lagarde warned of more downside risks for the Eurozone economy. In contrast, strong US Retail Sales data at 0.4% versus the expected 0.3% suggests that US consumers remain confident, reinforcing the narrative of robust domestic demand.

Oil prices may remain volatile as geopolitical risks in the Middle East, uncertanity surrounding US election and fluctuating market sentiment influence price movements. The strength of the US dollar also adds complexity, as a stronger dollar could weigh on oil prices by making commodities more expensive for foreign buyers. However, the combination of steady demand, tightening inventories, and geopolitical concerns has provided some relief for now.

From a techinical point of view, the bias remains bearish as long as the price stays below the 50-day SMA. A close above 72.3 could trigger a short-term recovery toward 74-76. However, if 71 fails as support, further declines toward 65.7 are on the cards. Traders should monitor these levels and watch for any changes in momentum before taking positions.