Article by: ETO Markets

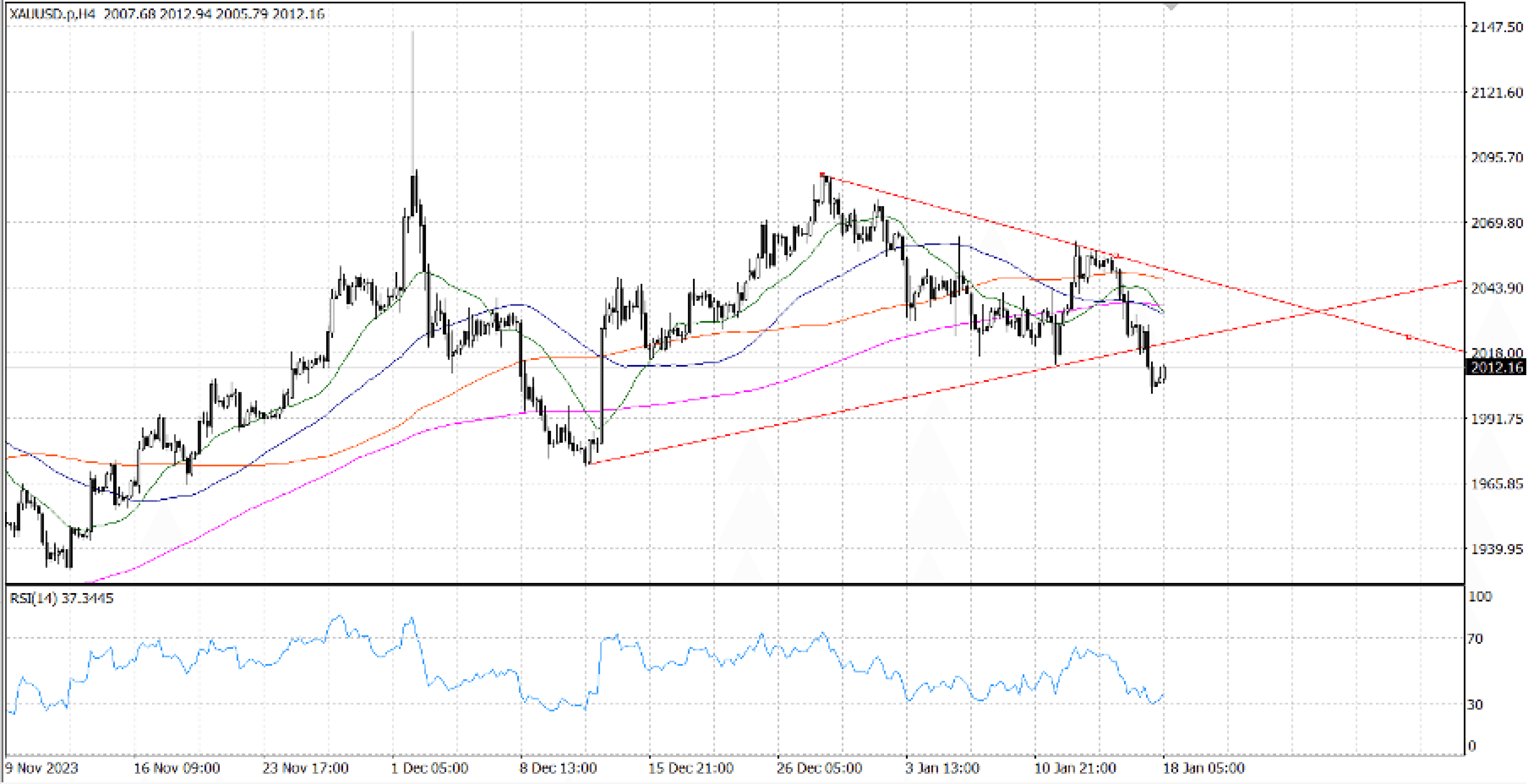

Following decreased expectations for an impending change in the Federal Reserve's policy stance, any significant rebound in the price of gold still looks elusive. In fact, following the announcement of positive US Retail Sales data on Wednesday that indicated a robust US economy, market players further reduced their expectations for an interest rate drop in March. This benefits the USD bulls and maintains support for higher US Treasury bond yields. Therefore, it would be wise to hold off on declaring that the XAU/USD has formed a near-term bottom unless there is significant follow-through buying.

The likelihood of a rate cut has dropped significantly from above 70% to 57%. Because stock market models are now pricing in fewer rate cuts for the year, US Treasuries are selling off, which is driving up yields. On Wednesday, rates increased by more than 2% for the second day in a row. At one point during the day, the 2-year bond yield even increased by 3%. Of course, rising yields typically follow stock prices in the opposite way, and this situation is no exception.

The mild data from Australia that was made public on Thursday doesn't seem to be supporting the Australian dollar in any way. January's seasonally adjusted unemployment rate kept steady at 3.9%, in line with estimates for December, while consumer inflation expectations stayed stable at 4.5%. The number of employed people fell by 65.1K, according to the Employment Change figures, despite the 17.6K rise that was predicted.

From a geopolitical standpoint, a more significant drop in the price of crude oil is being resisted by the ongoing disruption in supplies in the Red Sea. Many corporations have had to reroute their cargo around Africa due to the attacks on ships in the Red Sea, which were coordinated by the Houthi forces led by Iran. This has resulted in longer voyage times and higher expenses. The United States launched another series of strikes against Houthi targets in Yemen on Wednesday in retaliation for these attacks on shipping.

With the possibility of no more significant stimulus from China, geopolitical concerns in the Red Sea, and a reduction in bets on aggressive Fed rate cuts, risk sentiment is still weak. But the US Treasury bond rates' retreat from multi-week highs continues to be a drag on the US Dollar, meaning it does not profit from the safe-haven flows.

The next substantial cushion is observed in the $… zone, if the support around the $… mark fails. However, before the latter is contested, gold investors might find brief support around $...

Conversely, in order to start a comeback toward the triangle support at $…, the price of gold must be accepted above the 50-DMA support that has turned into resistance. Bearish commitments may be tested further up by the convergence of the 20-DMA and the triangle resistance at $...

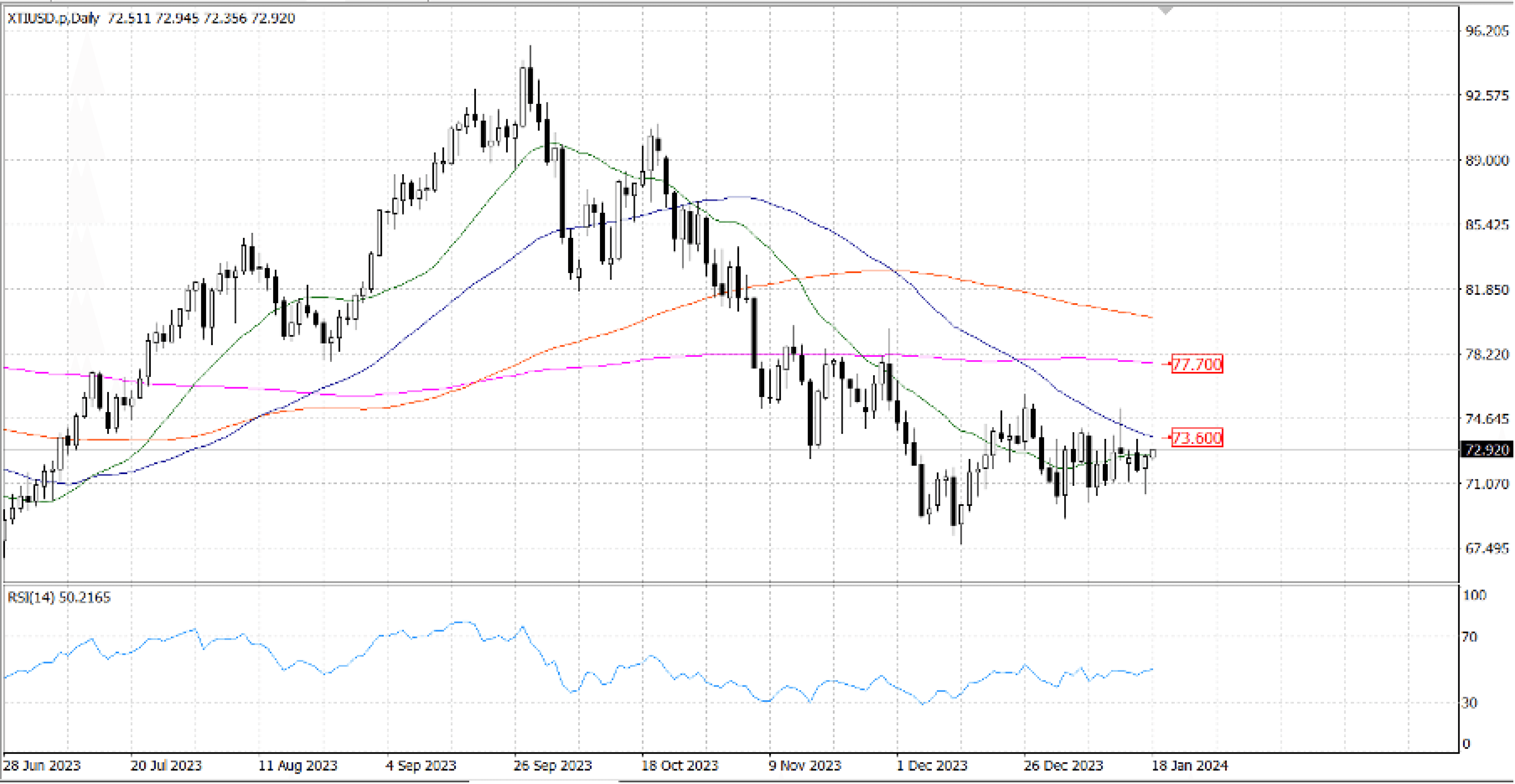

A more significant drop in crude oil prices is being prevented by the ongoing supply disruption in the Red Sea. Many corporations have had to reroute their cargo around Africa due to the attacks on ships in the Red Sea, which were coordinated by the Houthi forces led by Iran. This has resulted in longer voyage times and higher expenses. The United States launched another series of strikes against Houthi targets in Yemen on Wednesday in retaliation for these attacks on shipping.

US Crude Oil is heading back towards the $… handle, and Wednesday's early fall in WTI witnessed a comeback back above the 20-SMA near $... With a practically flat 200-DMA near $… and a sliding 50-DMA pushing down on intraday price action from $… , WTI is pushing into the middle of a long-term congestion pattern that is shaping up on daily candlesticks in XTI/USD.