Article by: ETO Markets

The forex market this week has been dominated by a combination of Fed policy expectations, Donald Trump's policy impact and US economic data. Fed Governor Dr. Adriana Kugler said inflation pressures had eased, but stressed the need for more data to justify a rate cut. The market interpreted this as a cooling of expectations for interest rate cuts in the short term, but Powell's mention of inflation is expected to achieve the target and supported expectations of future interest rate cuts. This policy uncertainty has intensified market volatility, and investors' confidence in the dollar has been affected.

Donald Trump, in a meeting with House Republicans, voiced support for tax cuts, lower interest rates and higher tariffs, measures that could inflate the economy and weaken the dollar. In addition, Trump warned Federal Reserve Chairman Jerome Powell not to cut interest rates before the November presidential election, but also said he would allow Powell to complete his term if re-elected. The statement added to market uncertainty, which could weigh on the dollar and drive demand for safe-haven assets.

On the economic front, U.S. retail sales were largely in line with expectations in June, with retail sales holding steady at $704.3 billion, showing resilience in consumer spending. The data failed to significantly boost the dollar as markets were more focused on the Fed's future policy path. Taken together, the market's focus on future Fed policy and the political environment will continue to dominate the FX market, and investors will need to pay close attention to relevant data and policy moves.

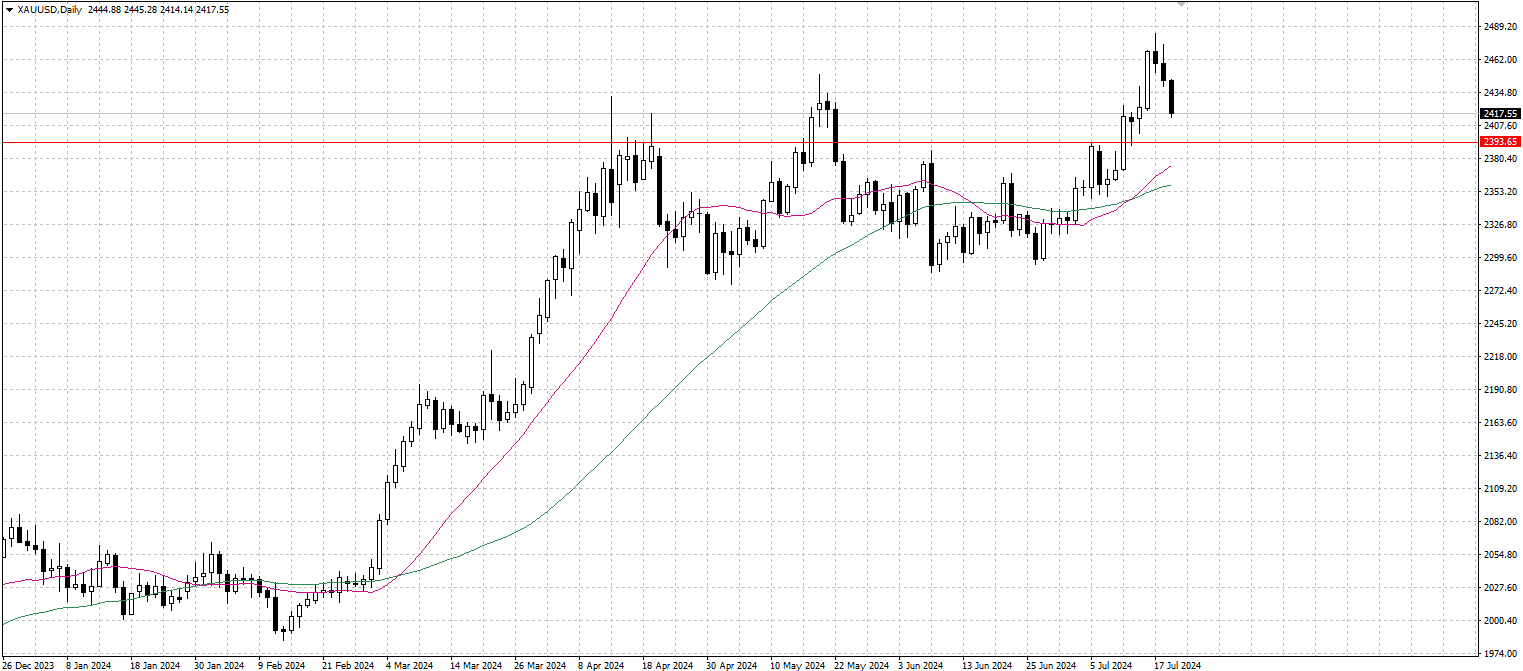

The price of gold (XAU/USD) has continued to fall this week amid the strengthening of the US dollar. Gold prices were lower for a third straight day through Friday, reflecting the dollar's extended rally from a more than four-month low the previous day. The fall was mainly due to the sharp depreciation of the euro as a result of ECB policy, which in turn pushed up the dollar. In addition, profit-taking has also contributed to the correction in gold prices to some extent, especially in the context of gold prices having risen more than 6.5% since the beginning of the month. Despite the pullback, expectations that the Federal Reserve may cut interest rates in September provided some support for gold. On Thursday, jobless claims data from the Bureau of Labor Statistics showed a loosening in the U.S. labor market and signs of easing inflation pressures, factors that support the Fed's upcoming rate-cutting cycle. The consensus is for a 100 percent chance that the Fed will cut rates in September and possibly two more before the end of the year. These factors make non-yielding gold more attractive in the market and are expected to limit further losses.

From a technical point of view, there is strong support around the $…-… area. A break below this level could trigger further technical selling, targeting the 50-day Simple Moving Average (SMA) support, which is currently around the $…-… area. A sustained break below this support could lead to a further dip to the $… area of the 100-day SMA and some intermediate support near the $…- $… area. On the other hand, gold saw immediate resistance near the Asian session high of $…. A break above this level could see gold climb further to the $…-… region. Given that the volatility indicator on the daily chart remains in positive territory, bulls could retest the all-time high, the $…-… area, and look to break through the psychological $… level.

The price of West Texas Intermediate (WTI) crude oil has fallen this week amid a stronger dollar. On Thursday, WTI traded around $81.20 a barrel during European hours. While WTI prices briefly rose during the Asian session, buoyed by an unexpectedly large drop in US crude inventories, gains were capped by a strengthening dollar. Data released by the U.S. Energy Information Administration (EIA) on Wednesday showed that U.S. crude inventories fell by 4.87 million barrels in the week ended July 12, far more than the 800,000 barrels expected and the 3.443 million barrels in the previous week. The data boosted expectations for crude demand, but a stronger dollar kept prices from rising further.

From a technical point of view, WTI prices are fluctuating around $…. While a strong dollar and a slowing Chinese economy are weighing on oil prices, a drawdown in U.S. crude inventories and expectations of a Federal Reserve rate cut are supporting prices. In the short term, WTI prices are likely to fluctuate in a range of $… to $….