Article by: ETO Markets

In the market, oil remains a prominent trade on Wall Street, buoyed by strong demand from China, where daily oil consumption is expected to reach 15M b/d as the country rebounds from Covid-Zero restrictions, with air travel acting as a significant driver. However, there are several bearish factors that could limit further price gains. Potential increases in OPEC+ supply, a possible Iran nuclear deal, and a stronger US dollar could push oil prices lower later in the year. Additionally, the US has seen a rise in crude stocks by 3.34 million barrels, adding to concerns of oversupply. Trump's trade tariffs could further weaken the global economy and dent fuel demand, which also dampens bullish sentiment. On the demand side, signs of slowing growth from the Eurozone and China add more uncertainty to the market. However, supply disruptions in Russia, including a 30%-40% reduction in oil flows from the Caspian Pipeline Consortium due to Ukrainian drone attacks, offer some support for prices. US dollar weakness, despite the Federal Reserve's hawkish stance, could provide temporary upside for oil, making it cheaper for international buyers. As traders await the release of official US crude inventory data, the market remains in a delicate balance, with both bullish and bearish factors at play.

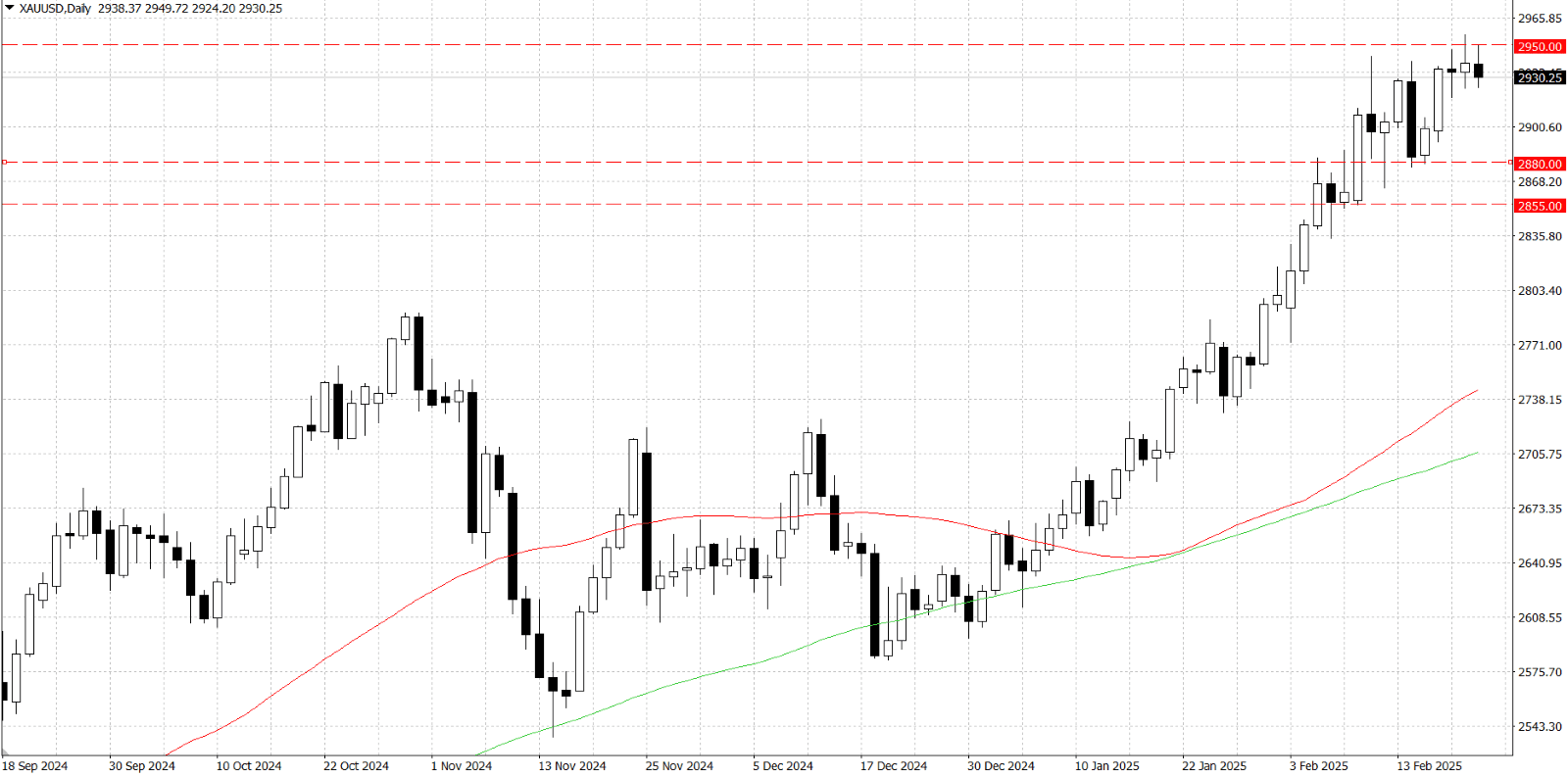

Gold (XAU/USD) pulls back from its record high near $… amid profit-taking, though its broader uptrend remains intact. Market sentiment remains bullish due to geopolitical risks, concerns over Trump’s tariffs, and expectations of rising inflation. Fears of a global trade war, triggered by Trump's 25% tariffs on steel and aluminum and additional levies on Chinese imports, continue to drive demand for the safe-haven metal. Meanwhile, a weaker US Dollar, lingering doubts over US consumer health, and uncertainty surrounding Federal Reserve policy further support gold prices. Despite recent gains, Fed officials remain cautious, with mixed signals on potential rate cuts. St. Louis Fed President Musalem warned of inflation risks, while Atlanta Fed President Bostic signaled room for two rate cuts this year, contingent on economic conditions. Traders now look to upcoming global PMI data and US economic reports, including Existing Home Sales and the Michigan Consumer Sentiment Index, for fresh market direction. While gold faces some near-term resistance, underlying factors such as geopolitical tensions and economic uncertainty suggest continued strength, positioning the metal for its eighth consecutive weekly gain.

From a technical perspective, gold's (XAU/USD) technical outlook remains bullish despite RSI nearing overbought levels at 70, warranting caution. The breakout above the $…–… range signals further upside potential, with immediate resistance at $…–…. A sustained move beyond this zone could reinforce bullish momentum. On the downside, $… serves as initial support, followed by $…. A breach below $… may accelerate declines toward $…–…, with further downside at $… and $…. Traders may await consolidation and follow-through buying before initiating fresh long positions, as the broader uptrend remains intact.

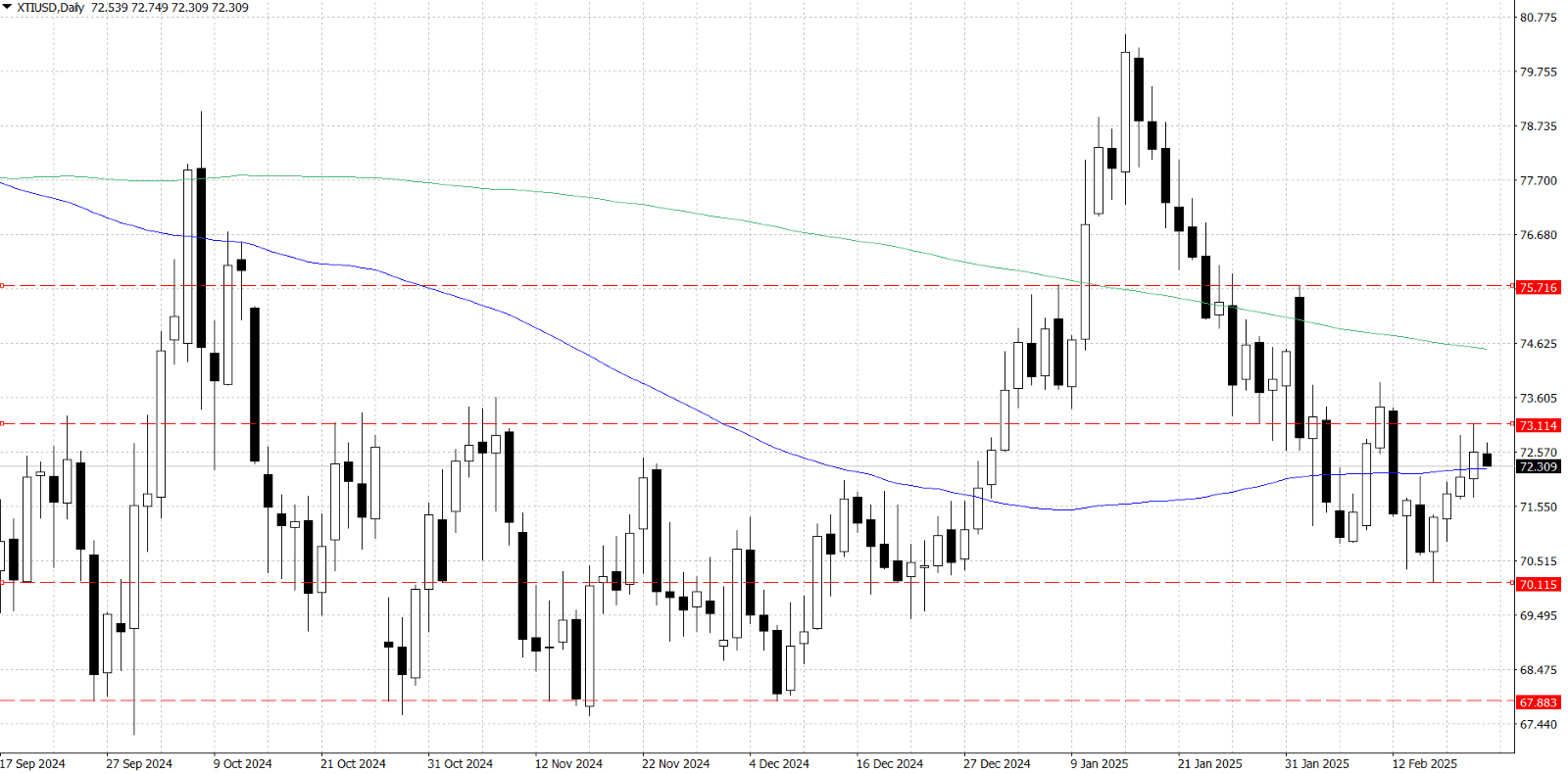

West Texas Intermediate (WTI) crude oil prices are consolidating gains in a narrow range around $… during the Asian session on Friday, aiming to break a four-week losing streak. Supply concerns persist following increased Ukrainian drone attacks on Russian oil infrastructure, while U.S. crude stockpiles rose, and gasoline and distillate inventories declined. A weaker U.S. dollar further supports oil prices, but concerns over Trump's trade tariffs potentially weakening the global economy and slowing demand from the Eurozone and China limit bullish momentum. Traders await global flash PMI data for further market direction.

From a technical perspective, WTI Oil has reached a key resistance area just above the $… level. A stronger resistance zone lies at $… with the 200-day moving average (MA). The 14-day RSI remains just below the 50 mark, indicating that bearish momentum is still in play. A break above the 50 level could signal a shift towards bullish momentum, potentially driving the price toward resistance at $… and even higher. On the downside, immediate support is provided by the 100-day MA at $…, just above the psychological $… level. Further support may be found around the swing low at $…, with the $… level coming into focus if the price continues to decline.