Article by: ETO Markets

This Tuesday, the Reserve Bank of Australia (RBA) announced its decision to keep the interest rate unchanged at 4.35%. In a press conference, Governor Michele Bullock clarified the RBA's stance, confirming discussions about potential rate hikes while ruling out any consideration of rate cuts at this time. She emphasized the RBA's ongoing concerns about inflation, indicating that the threshold for policy easing remains very high.

Hawkish remarks from the Federal Reserve (Fed) have supported the US Dollar Index (a measure of the dollar's value against a basket of major currencies). Cleveland Federal Reserve Bank President Loretta Mester stated that they prefer to see "sustained good inflation data" before making a firm decision. Meanwhile, Minneapolis Fed President Neel Kashkari mentioned that a rate cut in December might be a "reasonable forecast." According to the FedWatch tool, the probability of a rate cut in the September 18 decision is currently at 67%, which conflicts with the Fed's indication of only one rate cut in 2024. If US economic data continues to bolster hopes for a rate cut in September, the dollar may face challenges.

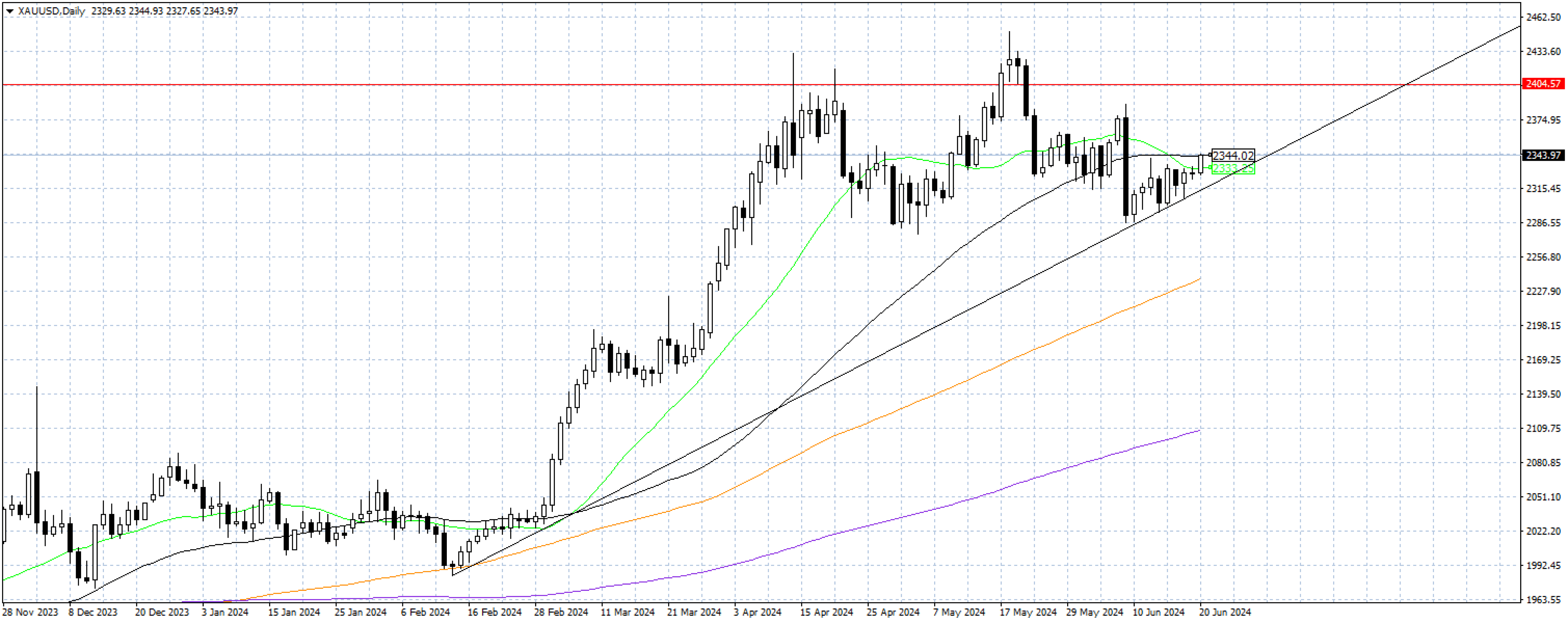

The weak US retail data released on Tuesday strengthened market expectations for a Federal Reserve rate cut in September, weakening the dollar against other currencies. Additionally, precious metals benefited from this, reversing three consecutive weeks of declines. However, trading volume decreased due to a public holiday in the US on Wednesday, as traders awaited the PMI (Purchasing Managers' Index) on Friday to help gauge the Fed's future moves.

Gold prices (XAU/USD) consolidated their strong gains from yesterday during Friday's Asian session, hitting a new two-week high at $2365. On Thursday, the US initial jobless claims rose to 238K, higher than the expected 235K, further confirming the weakness of the US economy. Additionally, the Bank of England's (BoE) dovish outlook boosted bets on an August rate cut, while the Swiss National Bank (SNB) unexpectedly implemented its second rate cut of 2024, which also supported precious metal prices.

The CME FedWatch tool shows a 58% probability of a 25-basis point rate cut in September, down from 62% the previous day. Additionally, despite weak US data, US Treasury yields rose on Thursday due to expectations of new supply next week, pushing the dollar to a weekly high. This led to the unusual simultaneous rise in both the US dollar index and precious metal prices.

From a technical perspective, gold prices (XAU/USD) have broken above the 50-day simple moving average at $… , becoming a trigger for new bullish traders. It is now fully breaking the downtrend, aiming for the $… -$… range, and poised to move towards the $… level. The 20-day simple moving average at $… has turned into strong support, making it difficult for sellers to push prices below this level. Additionally, the Relative Strength Index (RSI) at 55 indicates that gold has substantial room for further gains and the potential to create new highs.

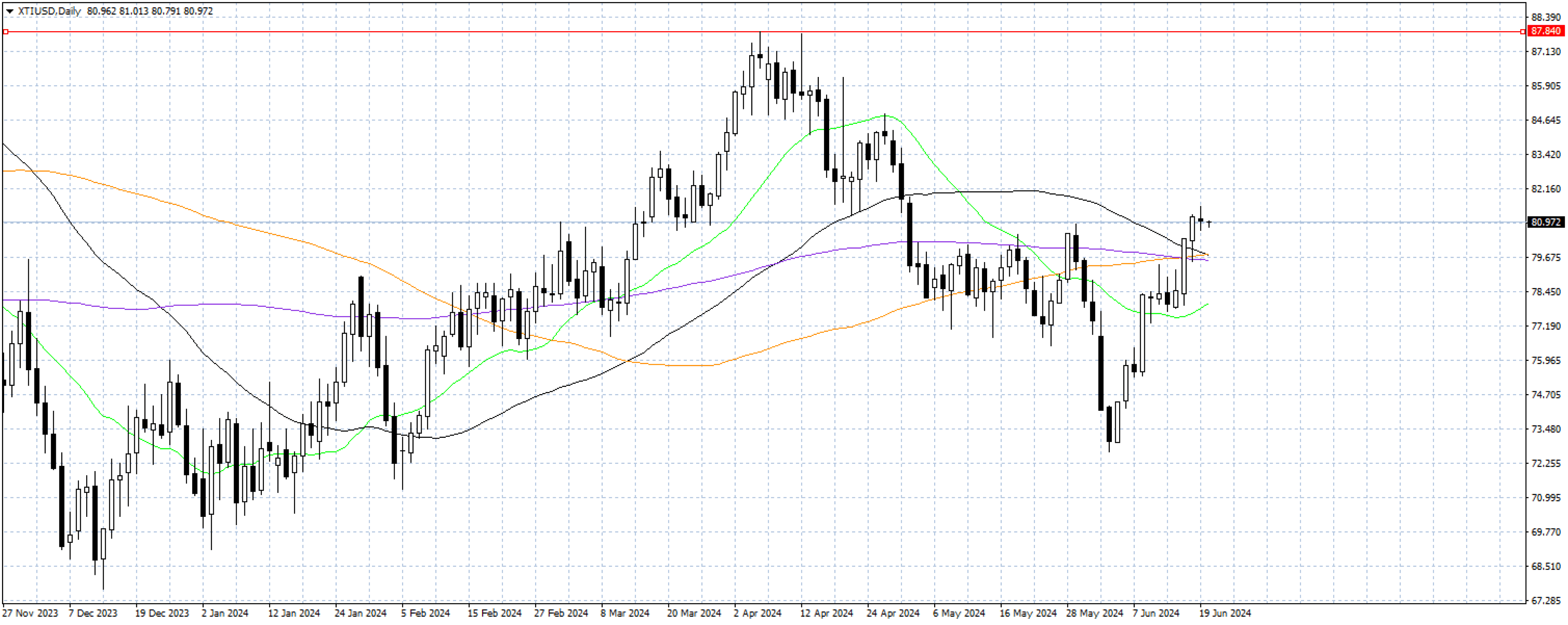

West Texas Intermediate (WTI) crude oil, the benchmark for US oil, reached a seven-week high on Wednesday, surpassing $81 per barrel despite US exchanges being closed for a public holiday. Commodities continued to rise, with WTI climbing above $81 per barrel. The American Petroleum Institute (API) reported another weekly increase in US crude oil inventories, while expectations of US rate hikes and concerns over China's economic slowdown may impact the upward trajectory of oil prices. Additionally, the Organization of the Petroleum Exporting Countries (OPEC) is expected to end voluntary production cuts later this year.

XTI/USD saw a technical rebound after the previous dip touched $… per barrel, with April's high of $… likely to hinder further oil price increases. The weakening bullish momentum could pull WTI crude back below the 200-day simple moving average of $… per barrel, leading to another decline in oil prices.