Article by: ETO Markets

The FOMC Minutes' cautious tone on the rate of interest rate decreases put pressure on the US Dollar Index to decline on Wednesday, even though US Treasury yields rose. The minutes of the meeting made clear that more proof of deflation was required in order to allay worries about upside risks. Fund futures suggest that almost 70% of the market expects the Fed to decrease rates at its June meeting.

The Australian dollar may face difficulties due to weaker Aussie money markets, as the S&P/ASX 200 Index declines for the third straight day amid negative sentiment. The Federal Open Market Committee Minutes, which were recently released and cautionary about interest rate decreases, could delay the start of a cycle of easing. Further shifting market sentiment toward the likelihood of no upcoming rate cuts were the minutes from the Reserve Bank of Australia's meeting earlier this week.

For the second consecutive day on Thursday, the Japanese Yen is still under attack versus its US counterpart and trades close to the weekly low despite a lack of follow-through selling. During the October–December quarter, the Japanese economy unexpectedly shrank for the second consecutive quarter, confirming a technical recession. It appears that expectations of an impending change in the Bank of Japan's policy position in the upcoming months have been shattered by this.

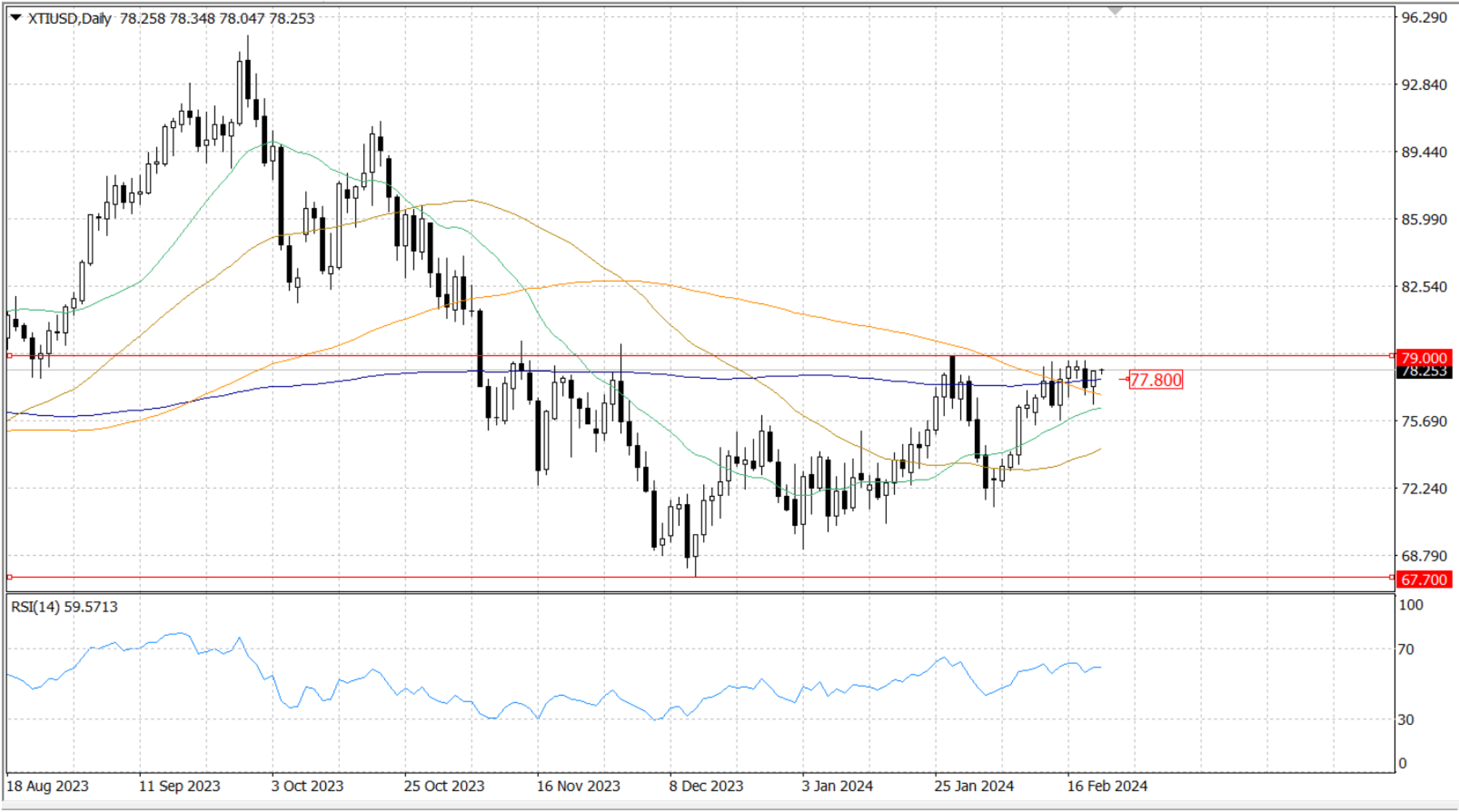

Israel carried out airstrikes on Hezbollah in Lebanon and Houthi attacks on a second commercial ship in the Red Sea. Israel has received advice from the US not to assault Rafah on the ground without a plan in place to protect civilians. WTI prices are rising as a result of growing concerns about the availability of crude oil due to the unrest in the Middle East.

The yield on US government bonds is pushing the market to multi-week highs; the 10-year Treasury note is currently trading at 4.31%, down from an early peak of 4.35%. Following the release of the minutes from the Federal Open Market Committee meeting on Wednesday, yields increased. According to the memo, policymakers are not in a rush to lower rates; instead, they would like to see more proof of inflationary pressure building before doing so. Policymakers acknowledged that the policy rate is probably near its peak for this tightening cycle, but they also emphasized the dangers of "moving too quickly."

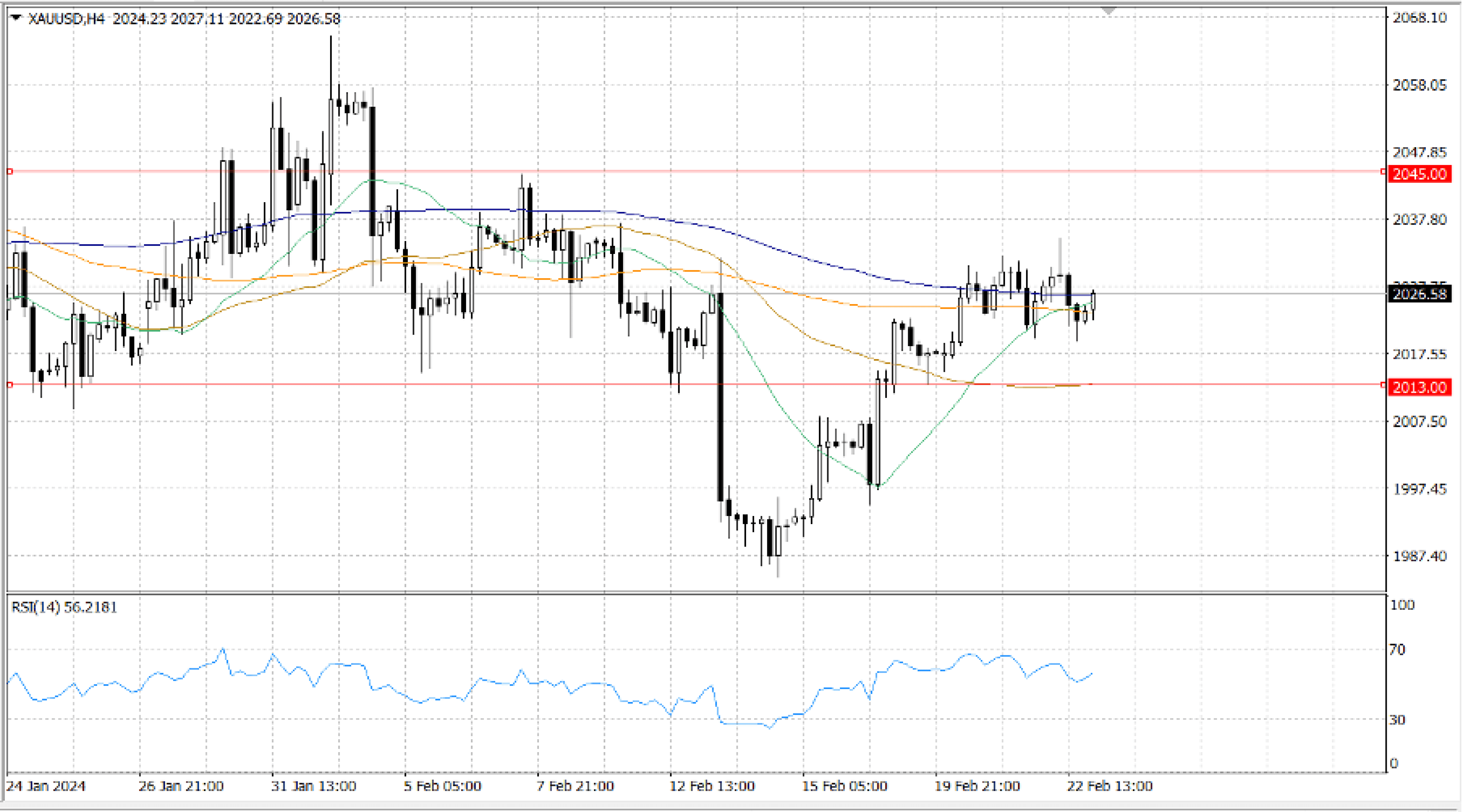

The yellow metal has been under selling pressure for the past two days, according to the 4-hour chart, but it appears that the bleeding has stopped. XAU/USD is slowly making up ground after hitting an intraday low of $... The Relative Strength Index has stabilized just above 50, indicating that technical indicators have ceased their downward trend. Simultaneously, XAU/USD is circling a little positive 100-SMA, while the 20-SMA turned slightly lower, nevertheless remaining well above the present level. The immediate resistance awaits around $...

In the wake of Middle East geopolitical unrest, barrel traders are continuing to factor in potential supply lane restrictions, which is WTI/USD is rising on Wednesday. Barrel prices are also being supported by expectations that increased US refinery activity will reduce the accumulation of US crude oil supplies; nonetheless, it is becoming more difficult for the energy markets to ignore the growing overhang of US barrel counts.

WTI/USD is rising toward $… per barrel as energy markets retrace their steps to near- term highs. The daily candlesticks are noticeably skewed sideways as bidders challenge the 200-DMA around $... Since reaching a high of $… in January, WTI/USD has been unable to break through into new territory, and longs of crude oil are finding it difficult to push WTI/USD higher into bull territory after barrel prices fell as low as $… in December.