Article by: ETO Markets

In the oil market, President Trump's tariff initiatives remain in limbo, creating uncertainty in currency markets, while attention has shifted to his pressure on OPEC and Saudi Arabia to lower oil prices. Speaking at Davos, Trump expressed disappointment with OPEC's inaction on crude prices and urged increased supply to ease energy-driven inflation, potentially enabling global central banks to cut rates. With oil prices trending downward, questions arise about the impact of China's green energy transition on its oil demand, as global production rises. This dynamic hints at a potential recalibration of energy markets, with increased supply clashing against diminishing demand from one of the world's largest consumers.

Meanwhile, Wall Street surged to record highs on Thursday, driven by President Trump’s push for AI investments, reviving last year’s tech momentum. Despite a slight rise in bond yields, volatility indexes hit year-lows, fostering strong equity inflows alongside subdued interest rates. A drop in oil prices further eased inflation concerns, lowering the two-year yield and energizing bullish sentiment. Meanwhile, robust demand for sovereign debt across developed markets, supported by benign inflation readings in the US, Canada, and Europe, reduced 10-year Treasury term premiums to their lowest this year, signalling a favourable environment for sustained market optimism.

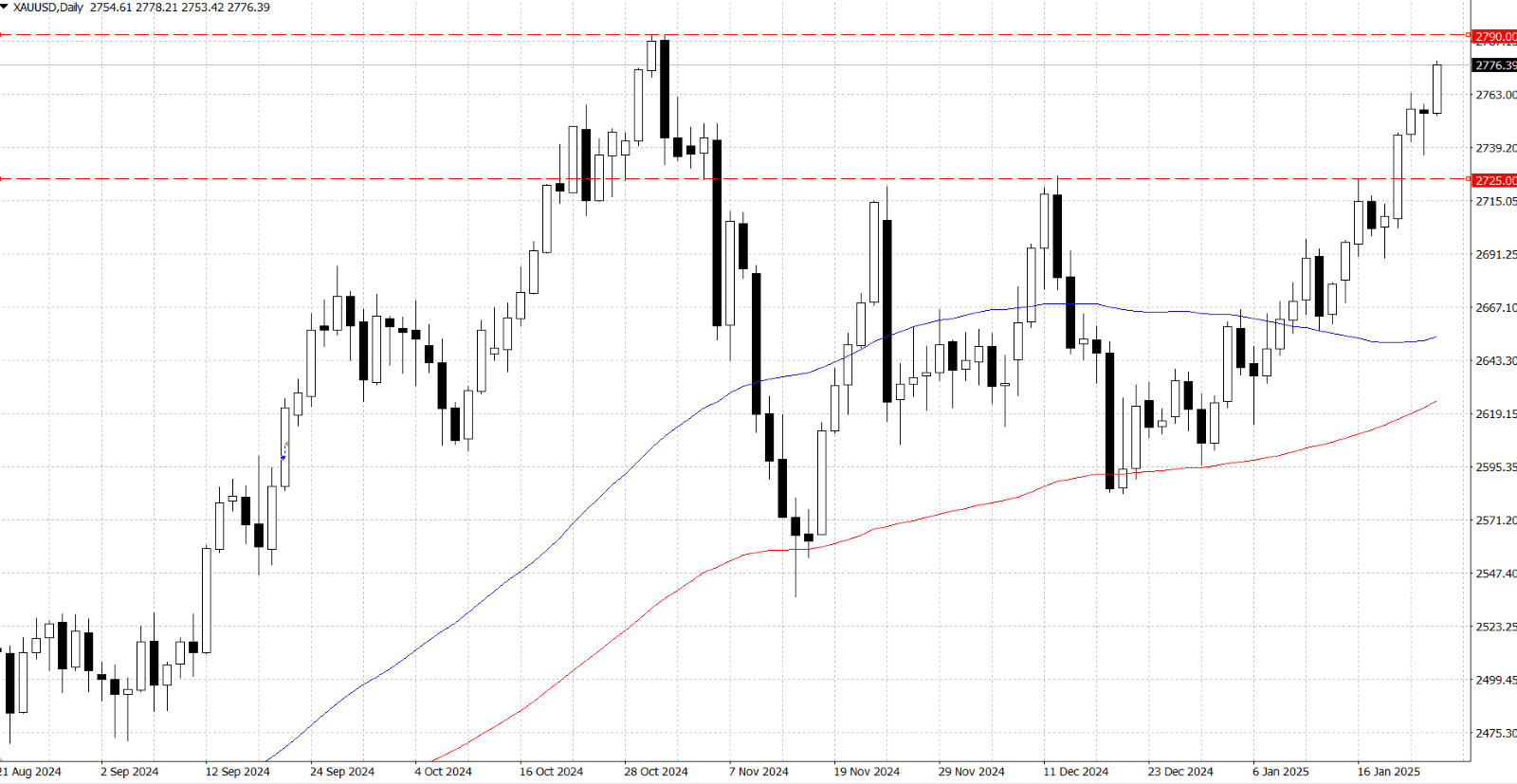

Gold prices (XAU/USD) resumed their upward trend during Friday's Asian session, reaching the highest level since October 31, as lower US Treasury yields, and a weakening US Dollar bolstered the safe-haven metal. The Dollar's slide followed US President Donald Trump's remarks suggesting he would rather avoid tariffs on China and his calls for the Federal Reserve to cut interest rates, fuelling expectations of further policy easing. Investors' concerns about the economic fallout from Trump's protectionist policies also supported gold demand, though overbought conditions and a bullish equity market limited fresh buying. The metal remains poised for a fourth consecutive weekly gain as traders await global PMI data for additional market cues.

From a technical perspective, Gold's dip-buying on Thursday and subsequent rise confirm a bullish breakout above the $…-… supply zone. However, with the daily RSI nearing overbought levels, a period of consolidation or a minor pullback may be prudent before further gains. Upside momentum is expected to face strong resistance near the all-time high of $…. On the downside, immediate support lies at $…-…, with further support at $…-…. A drop below the $…-… resistance-turned-support zone could signal a bearish shift and open the door to deeper declines.

West Texas Intermediate (WTI) crude oil is trading around $… on Friday, extending its decline following President Trump’s call for Saudi Arabia and OPEC to lower oil prices during his Davos speech. Market uncertainty surrounding Trump’s tariffs and energy policies, along with expectations of increased US production after his declaration of a national energy emergency, further weigh on prices. Despite a ninth consecutive weekly decline in US crude inventories, the 1.017-million-barrel draw fell short of market expectations. Traders now await Trump’s policy developments and the preliminary US PMI data, as a weaker-than-expected outcome could lower the US Dollar and lend support to WTI prices.

From a technical perspective, XTI/USD is trading in bearish momentum after touching above the $… (January 15) as the strong resistance level. However, the long-term downward trendline from January 9 remains intact, and a golden cross, with the 50 days Simple-Moving-Average crossing above the 100 days SMA, suggests a potential bullish outlook in the long run. On the upside, WTI's price may remain between the $… support level and the $… resistance level. On the downside, a break below $… could shift sentiment bearish, targeting to $….