Article by: ETO Markets

This week, the main drivers for the foreign exchange market have come from dovish expectations from the Federal Reserve and heightened global geopolitical risks. Expectations that the Fed will cut interest rates by another 50 basis points in November have put the dollar under renewed pressure after a brief recovery. This uncertainty has provided continued support for non-yielding gold, especially as the global economic outlook darkens and fears of a recession grow.

While some Fed officials have tried to counter more aggressive easing, market sentiment remains in favor of continued Fed rate cuts, and a speech by Fed Chairman Jerome Powell on Thursday is expected to give the market more clues on the path of future rate cuts. As the dollar weakens, other major currencies such as the euro and the British pound continue to benefit. At the same time, the second quarter US GDP final reading, durable goods orders and other data will also have a short-term impact on the trend of the dollar.

On the geopolitical front, tensions in the Middle East have further escalated, the conflict between Israel and Lebanon has intensified, and global investors' demand for safe-haven assets has increased significantly. In addition, despite the announcement of a new round of economic stimulus measures in China, uncertainty about its effects and the risk of a global economic downturn remain, which also weighs on risk assets.

Overall, the foreign exchange market this week has been affected by expectations of a Fed rate cut, the US dollar is under pressure, while safe haven currencies such as the Swiss franc and the Japanese yen are likely to continue to benefit, and safe haven assets such as gold are also supported.

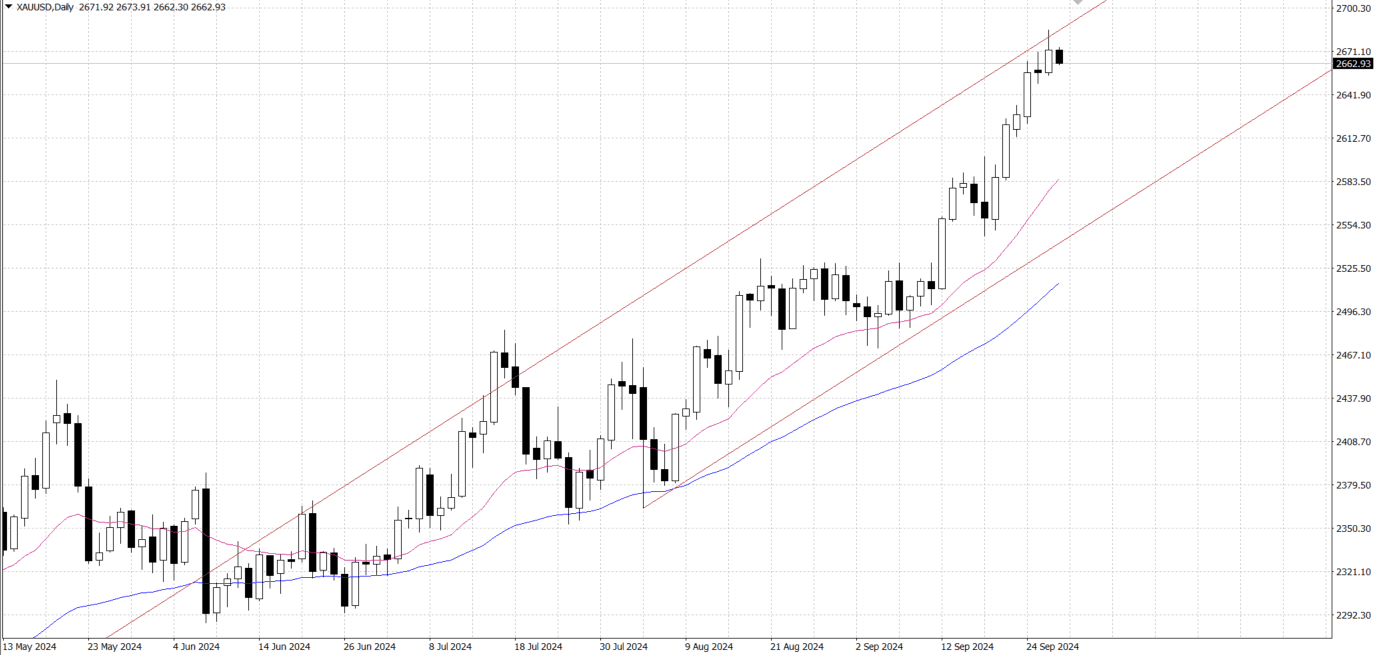

Gold climbed to a record high on the back of dovish Fed policy expectations. The Fed is widely expected to cut interest rates by another 50 basis points in November, which has sapped momentum from the dollar's rally and provided support for non-yielding gold prices. At the same time, escalating geopolitical tensions in the Middle East have increased the demand for safe-haven flows into the gold market. In addition, China's new round of economic stimulus measures also provided additional support for gold. However, the prospect of a pick-up in global economic activity due to increased risk appetite in the market restrained further gains in gold.

Traders' focus now turns to the upcoming release of the US Personal consumption Expenditures (PCE) price index, which will influence the Fed's future rate cut path and give fresh impetus to gold. Despite the modest dollar gains, the market still expects that the possibility of further interest rate cuts by the Federal Reserve will limit the room for dollar appreciation and support higher gold prices.

Technically, the Relative Strength Index (RSI) on the daily chart shows that gold prices are overbought, indicating that a pullback is possible in the near term. However, gold has broken out of the short-term uptrend channel, indicating that its path of least resistance remains upward. As a result, gold prices are likely to move higher after consolidation.

In the current situation, the support level for gold is near $…, an area that can be seen as an opportunity to buy on dips. If gold can hold the key support level at $…, the bulls are expected to push gold even higher. Conversely, a break below $… could trigger some technical selling and bring gold back to the $… area, which in turn could test the $… and $… support levels.

Crude oil prices have fallen sharply this week, especially after Saudi Arabia was rumored to be abandoning its target price of $100 a barrel. While China's stimulus measures have boosted commodity demand, expectations of an imminent return to normalisation of production in Saudi Arabia and a possible ceasefire on the Lebanese border have put downward pressure on oil prices. In particular, the Financial Times reported that Saudi Arabia may increase production, further weakening market concerns about a shortage of crude oil supply. In addition, signs that the Libyan oil market is expected to restart also put more pressure on crude bulls.

From a technical point of view, the price of WTI crude oil has seen a sharp correction this week and is currently trading near $… and Brent at $…. The key support level for crude oil prices is $…, which is the triple floor for the summer of 2023. If it breaks below this level, the next significant support is at $…, which is the lowest since March and May 2023.

On the upside, $… becomes the first resistance level in the near term, and if it can break this level, it could recover to the 55-day Simple Moving average (SMA) of $… and further challenge the high of $…. In addition, the 100-day SMA at $… will provide additional resistance on the way up.