Article by: ETO Markets

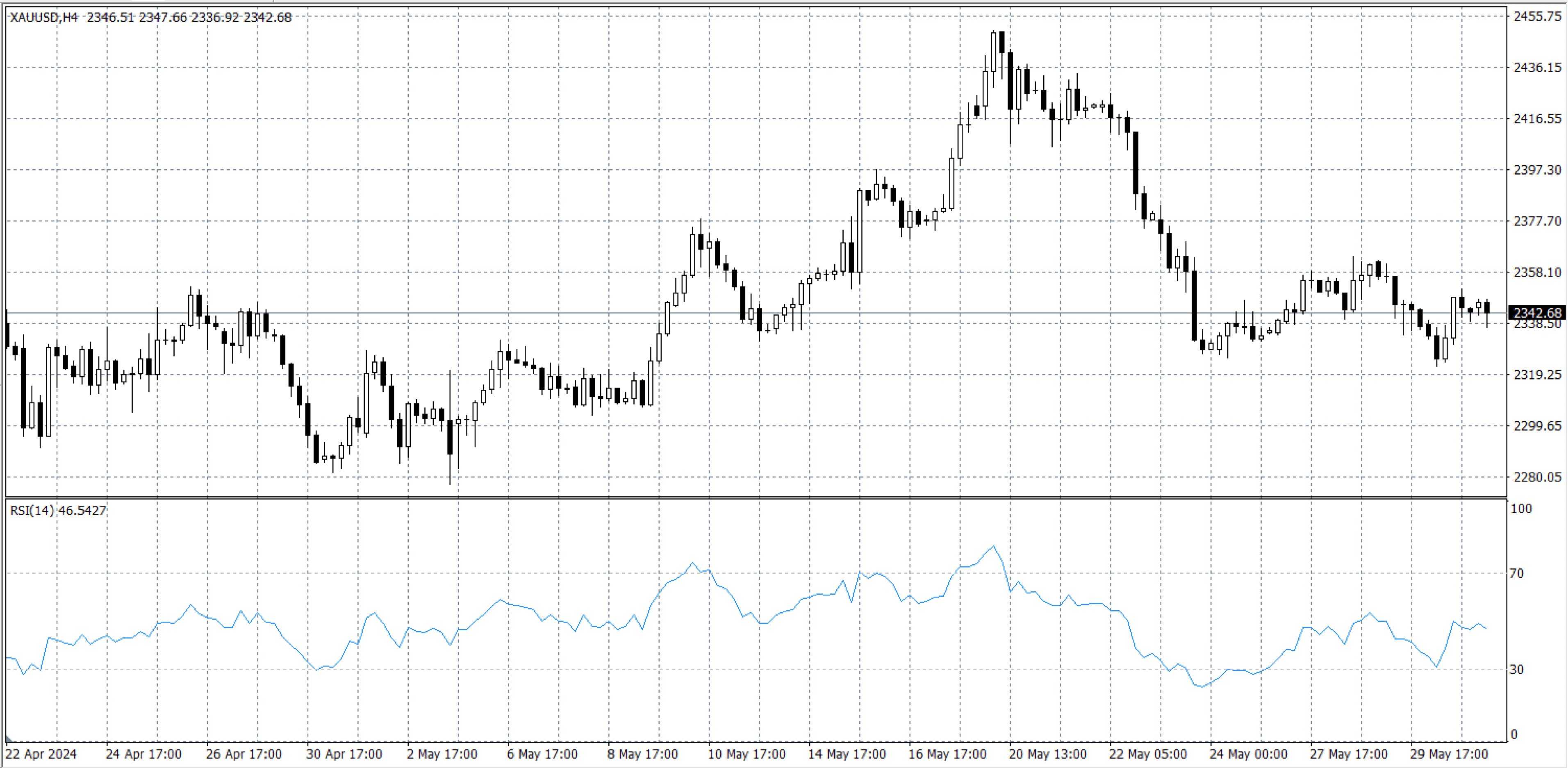

Gold prices edged up on Friday as the US dollar softened and US yields fell. Traders are increasingly betting that the Federal Reserve will cut interest rates this year, especially after the latest weak US GDP data. Additionally, ongoing geopolitical risks and conflicts in the Middle East are boosting gold’s appeal as a traditional safe-haven asset.

Later today, gold traders will focus on the US April Core Personal Consumption Expenditures Price Index (Core PCE), the Fed’s preferred inflation measure. Forecasts suggest a 0.3% month-over-month and a 2.8% year-over-year increase. Higher-than-expected inflation data could support the US dollar and limit gold’s upward movement.

Stay updated with these key factors as they play a crucial role in influencing gold prices.

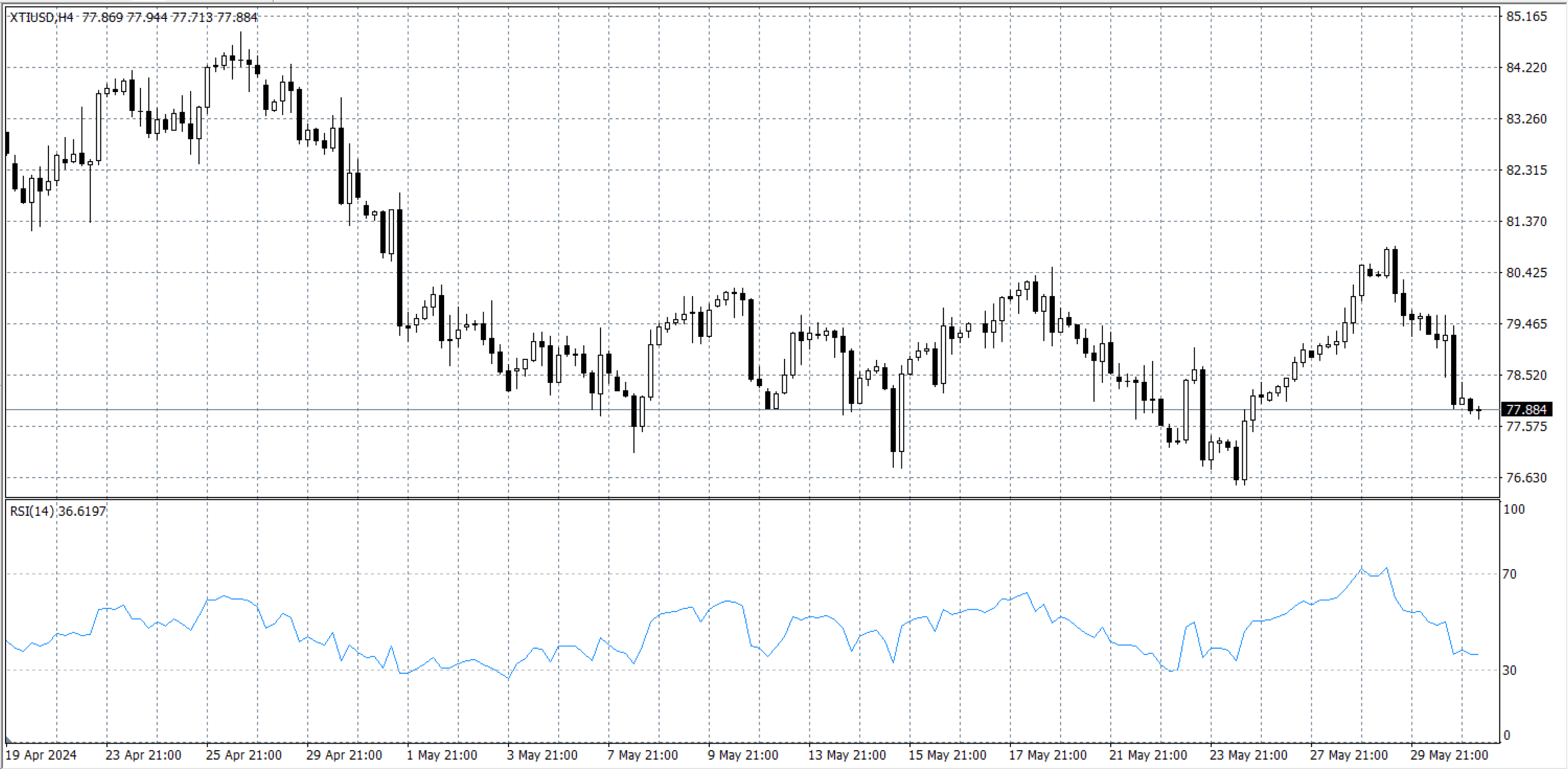

On Thursday, West Texas Intermediate (WTI) US Crude Oil prices fell, as the energy market ignored a significant drop in US Crude Oil stocks. The Organization of the Petroleum Exporting Countries (OPEC) and its allies, known as OPEC+, are expected to extend their current voluntary production cuts. The OPEC+ meeting will be held online on Sunday, June 2.

Both the American Petroleum Institute (API) and the Energy Information Administration (EIA) reported sharp declines in US Crude Oil inventories this week. The API noted a decrease of 6.49 million barrels for the week ending May 24, while the EIA reported a reduction of 4.156 million barrels. Despite these declines, traders were concerned by the rise in refined products. Refinery runs increased significantly, outpacing demand. The EIA reported that refinery-held Crude Oil increased by 601,000 barrels per day, the highest level since December 2019. Additionally, refinery utilization rates rose by 2.6%.

Inventories of refined products, including gasoline and natural gas, also increased for the week ending May 24, negatively impacting market sentiment. The upcoming OPEC+ meeting is unlikely to alleviate these concerns.

According to sources, OPEC+ is considering extending some Crude Oil output cuts into 2025, along with extending the current voluntary production cuts into the third or fourth quarter of 2024. Traders believe the current cuts are insufficient and are looking for more substantial measures from OPEC+ to balance production with global demand.