Article by: ETO Markets

Following the FED policy meeting, when rates were left steady and no rate reduction is anticipated before December 24th, US Treasury yields decreased. The 30-year yield has increased while the 10-year yield has somewhat decreased, giving the German yields a mixed picture. All things considered, the medium-term trend is upward. The range of trading for the Indian GOI yields, 10yr and 5yr, is 7.15-7.20/22%.

Assuming the Fed maintains higher interest rates for an extended period of time, the Dow Jones recovery wanes. For now, the Dow Jones, Dax, and Nikkei appear to be range bound. The Nifty has dropped, but before a corrective decline occurs, there is a potential that it may rise above 23000.

The European Central Bank is taking a more dovish posture than the US Federal Reserve, the Eurozone may experience difficulties. As anticipated, April's inflation in the Eurozone remained stable, according to recent inflation figures. Furthermore, core inflation declined, which increased expectations of an ECB interest rate cut in June.

Following Fed Chair Powell's statement that it will probably take longer than previously expected for the bank to have enough confidence in the trend of inflation before starting to decrease interest rates, crude prices have plummeted. Nonetheless, there are short-term supports for crude prices that, if they hold, may offer some relief. While still ranging, precious metals are facing immediate resistance above, which, if it holds, might be negative for the upcoming sessions.

At its policy meeting in May, the Federal Reserve kept the Federal Funds Rate unchanged, as anticipated, between 5.25% and 5.5%. Powell clarified, however, that central bankers are looking for "more confidence" that the rate of inflation is approaching 2%. "It's likely going to take longer than anticipated to achieve such increased confidence. Powell continued, US Fed is ready to keep the current target federal funds rate in place for as long as it is appropriate.

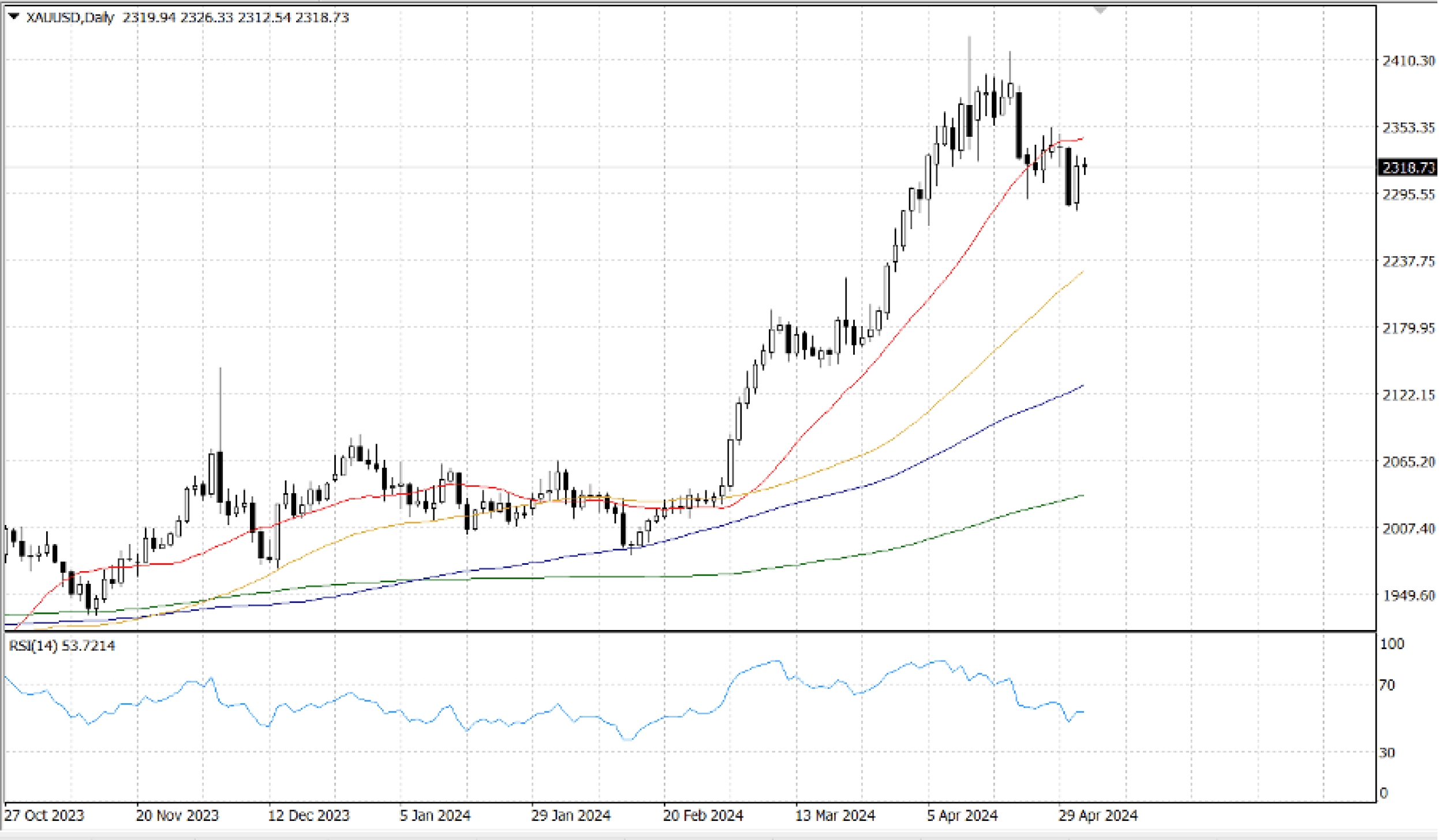

The price of gold is confronted with strong resistance at $…, the 20-DMA. A persistent increase over that mark will rekindle bullish sentiment and necessitate a challenge of the $… round barrier. The high of $… on April 22 is the next topside target.

Alternatively, the multi-month low of $… will be tested below the $… barrier, which represents the immediate support. If the latter is not defended, there will be a further decline toward the 50-DMA, which is currently around $...

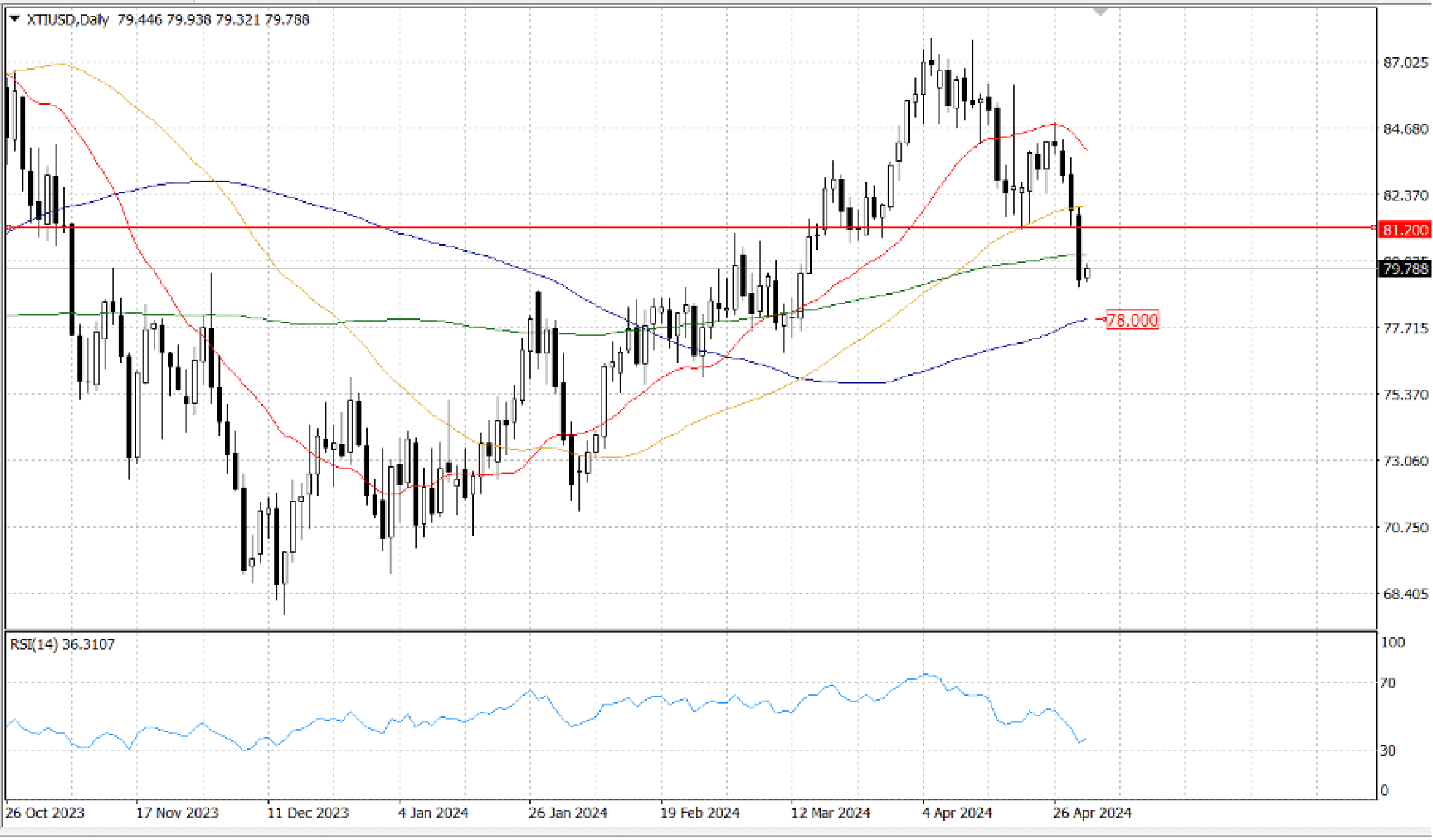

WTI prices decline as there are indications of a deeasing of geopolitical tensions in the Middle East. The US and Saudi Arabia are debating a deal that would offer Riyadh security assurances and potential diplomatic relations with Israel in the event that its government terminates the conflict in Gaza. However, the growing geopolitical threats may increase the region's anxiety over a disruption in the oil supply and drive up the price of black gold.

The decrease on Wednesday forced WTI out of a stable demand zone between $… and $… per barrel and back below $... US Crude Oil is currently trading down about 10% from the previous swing high of $… in early April, and WTI is not trading into the 200-DMA near $... The immeidate support awaits at $…, while the resistance stays around $…