Article by: ETO Markets

In the oil market, oil prices continued their decline over the past week despite a brief rebound on Monday following Trump’s tariff plans. A slack in the US oil market is weighing on prices, as rising rig counts initially signalled increased demand, but higher-than-expected crude inventory builds from API (+5.025M) and EIA (+8.664M) indicate oversupply. US tariffs on Chinese imports and China's retaliatory levies on US crude, LNG, and coal could further dampen US oil exports, pressuring prices. Meanwhile, OPEC+ reaffirmed its commitment to maintaining production limits, with declines in Iranian and Nigerian output, and Saudi Arabia raising its crude prices, signalling market tightness. If OPEC+ intensifies supply restrictions, oil prices may find some support in the coming weeks.

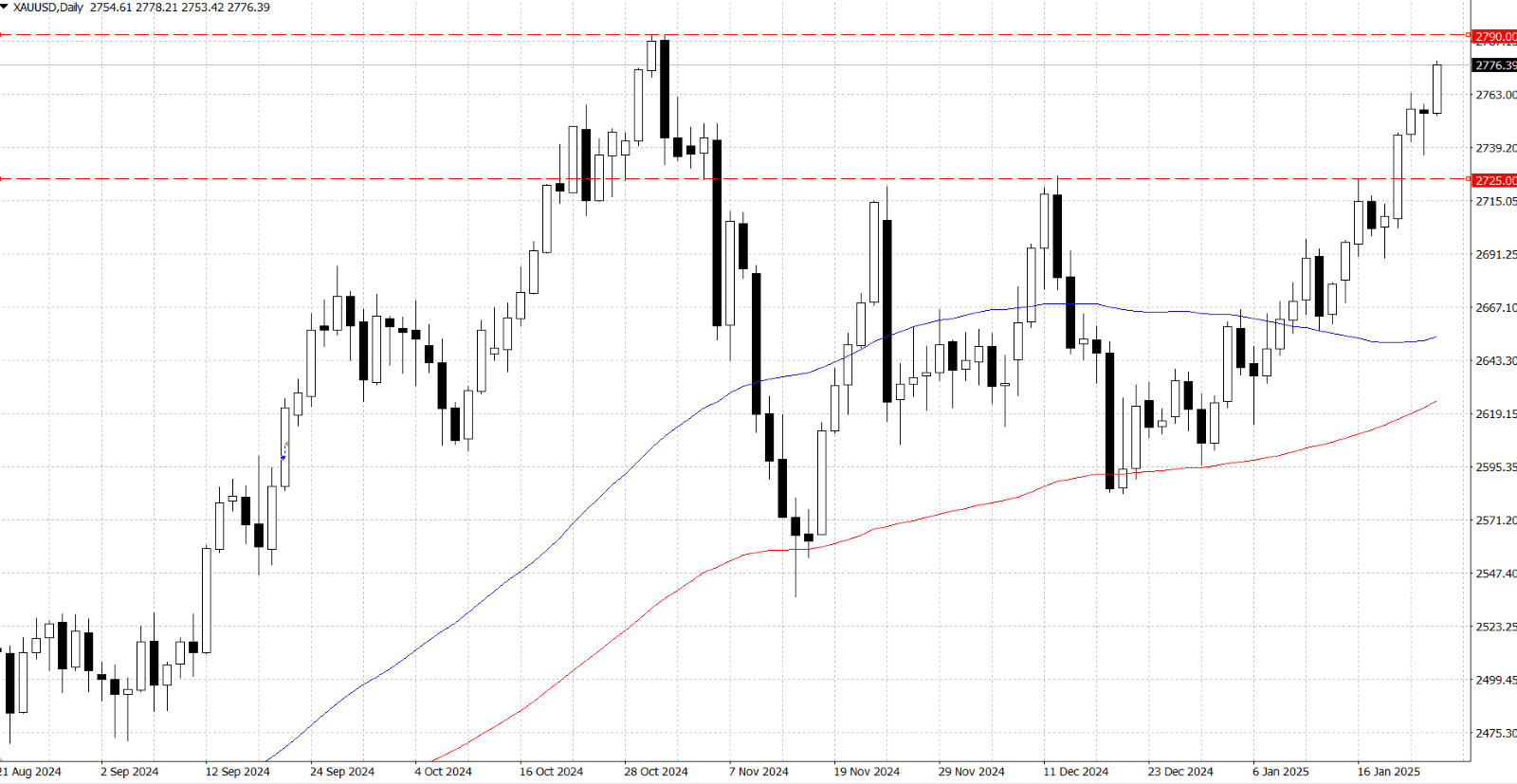

In the precious metal market, market focus remains on US labor market data, which will influence expectations for Federal Reserve rate cuts and impact the US Dollar, Treasury yields, and gold prices. The US economy is projected to add 170,000 jobs in January, with the unemployment rate steady at 4.1% and wage growth slowing slightly to 3.8%. A weaker-than-expected NFP report could fuel dovish Fed bets, pushing gold toward the $2,900 mark, while a stronger reading may reinforce the Fed’s hawkish stance, boosting the USD and triggering a gold price correction. The Greenback remains under pressure despite easing trade war concerns, allowing gold to consolidate near record highs.

Gold prices (XAU/USD) remain near record highs as escalating US-China trade tensions continue to drive demand for safe-haven assets. China’s retaliatory tariffs on US goods, following President Trump’s 10% levy on Chinese imports, have intensified economic uncertainty, further supporting gold. Additionally, expectations that the Federal Reserve will maintain an easing bias have kept US Treasury yields near multi-month lows, weakening the US Dollar and boosting the non-yielding metal. US unemployment claims rose to 219K, reflecting potential labor market softening, while Fed officials offered mixed signals—some cautioning against overheating, while others noted the labor market remains too strong for imminent rate cuts. Market participants now await the US Nonfarm Payrolls (NFP) report, which is expected to show a slowdown in job growth. The data will be crucial in shaping market expectations regarding the Fed’s interest rate outlook, which, in turn, will influence the USD’s trajectory and gold’s next major price movement.

From a technical perspective, gold’s recent bounce reinforces a positive near-term outlook, though the RSI suggests overbought conditions, warranting caution. The immediate resistance level could at $… and the further level could be at $… with overbought considerations. A period of consolidation may be needed before further gains. Key support levels lie at $…, followed by $… and the $…-$… zone, with $… as a critical threshold. A decisive break below $… could trigger technical selling, potentially pushing XAU/USD towards the $…-$… region, a key resistance-turned-support level that, if breached, may signal a deeper correction.

West Texas Intermediate (WTI) crude oil is trading around $…-$… range, edging lower amid concerns about weakening demand, particularly after China imposed retaliatory tariffs on US crude oil imports in response to US tariffs. This intensifies fears of a global economic slowdown and reduced energy demand, especially in China, the world’s largest oil importer. Additionally, US crude inventories rose by a larger-than-expected 8.664 million barrels last week, signaling softening demand. However, rising geopolitical tensions in the Middle East, including potential US actions in Gaza and sanctions on Iran, could provide some support for WTI prices by tightening supply concerns.

From a technical perspective, WTI crude remains in a downward trend despite a brief rebound during the Asian and European sessions. The persistent bearish momentum, guided by a descending trendline, suggests further declines, with the RSI nearing 30, indicating intensifying selling pressure. If bearish sentiment continues, WTI could break below the $… support level and target $…. A reversal to a bullish outlook would require a decisive break above the downward trendline, surpassing the $… resistance level, and further advancing past $… to signal a potential trend shift.