Article by: ETO Markets

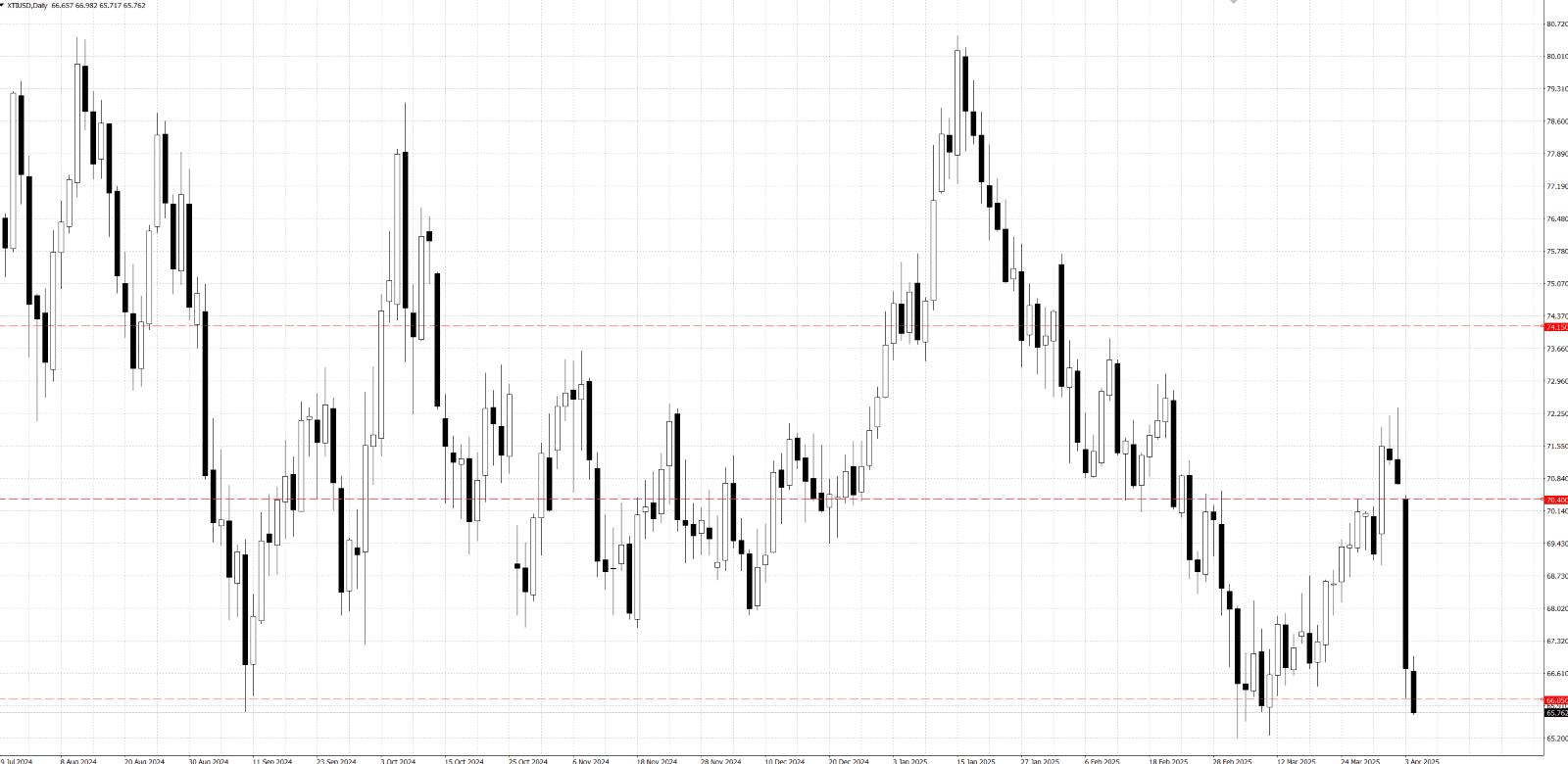

West Texas Intermediate crude oil has been trading with a negative bias for the fourth consecutive day, sliding below the $66/barrel mark during the Asian session and nearing its lowest level in over three weeks, which sets the stage for heavy weekly losses. Concerns over President Trump’s sweeping reciprocal tariffs, which have raised the specter of a widening trade war that could dampen economic growth and reduce fuel demand, are weighing on prices. Additionally, the unexpected move by eight OPEC+ members to phase out production cuts and boost combined output by 411,000 barrels per day in May has intensified oversupply worries. At the same time, the US Dollar remains near its lowest level since October amid expectations that a tariffs-driven economic slowdown might compel the Federal Reserve to resume its rate-cutting cycle, thereby offering some support to USD-denominated commodities and discouraging overly aggressive bearish bets on crude. Investors are now keenly awaiting the US Nonfarm Payrolls report—which is expected to show an addition of 135K new jobs in March with the unemployment rate steady at 4.1%—as it could provide fresh impetus and influence short-term trading dynamics for crude oil, all while trade-related headlines continue to dominate market sentiment.

Gold prices have been struggling to maintain momentum after a late rebound from the $3,054 level, as fresh selling pressure emerged during the Asian session. This pullback comes amid a broader risk-off sentiment driven by growing concerns that President Trump’s imposition of reciprocal tariffs could slow global economic growth and potentially trigger a US recession. Despite these bearish elements, safe-haven demand for gold has cushioned further declines, supported by expectations that the Federal Reserve might soon restart its rate-cutting cycle in response to a tariffs-induced economic slowdown. This anticipated policy shift has kept the US Dollar near a multi-month low, further underpinning gold's appeal. Additionally, traders have been cautious ahead of the crucial US Nonfarm Payrolls report, with other economic data—such as a decline in the ISM Services PMI and a slight drop in new unemployment claims—adding to the market uncertainty. Overall, while gold faces some selling pressure and repositioning trades, the combination of safe-haven demand and supportive economic fundamentals is likely to prevent a significant corrective slide from its recent highs.

From a technical perspective, gold appears to have a key support level near the $…–… horizontal zone—coinciding with the 100-period SMA—which is critical for short-term traders. A sustained break below this level could trigger further technical selling, pushing prices down toward the $… psychological level. Conversely, on the upside, the $…–… resistance zone serves as an immediate hurdle, followed by resistance at approximately $… and the all-time peak around $…. Overcoming these resistance levels could spur bullish sentiment and extend the recent four-month uptrend in gold prices.

The US oil market is showing signs of loosening, with a reduction in active rigs—as the Baker Hughes count dropped by two—and unexpected inventory builds reported by API (an increase of 6.037 million barrels) and the EIA (up by 6.165 million barrels). These factors indicate that US oil production has recently outpaced demand, creating a bearish backdrop. Adding to this, the Trump administration’s announcement of sweeping retaliatory tariffs—including a 20% duty on the EU and a combined effective rate of 54% on Chinese imports—raises concerns over a potential slowdown in the Chinese economy, which is critical as China is the world’s largest oil consumer; any resulting dip in Chinese demand could further depress oil prices. On the supply side, the OPEC+ cartel has accelerated plans to boost production by 411,000 barrels per day in May, signaling increased supply that may also weigh on prices, although the decision leaves room for adjustments should market conditions change. Complementing these fundamental pressures, the technical analysis of WTI crude oil reveals a persistent negative bias, with prices sliding below the $66/barrel mark for the fourth consecutive day, which suggests that market sentiment is turning increasingly bearish. Collectively, these fundamentals and technical signals point toward a challenging near-term outlook for oil prices, characterized by oversupply concerns and a cautious trading environment amid escalating trade tensions.

From a technical standpoint, WTI crude oil is currently displaying a downward trajectory, with price action seemingly targeting the … support level. The bearish sentiment is reinforced by the RSI indicator, which is reading 40, further suggesting that market momentum remains on the downside. For the bearish outlook to persist, a decisive break below the … support is essential, potentially driving prices down to the next support at …. Conversely, if price remains confined within the range of … and …, a sideways bias may prevail. However, should the bulls gain control and push prices above the … resistance level, a bullish scenario could materialize, targeting the subsequent resistance at ….