Article by: ETO Markets

The offer made by Hamas for a truce and the release of captives detained in the Gaza Strip has been rejected by Israeli Prime Minister Benjamin Netanyahu. However, US Secretary of State Antony Blinken has raised the prospect of more talks to reach an agreement. Furthermore, a Hamas delegation headed by top official Khalil Al-Hayya is scheduled to travel to Cairo on Thursday in order to hold negotiations with Egypt and Qatar with the goal of coming to a ceasefire.

The price of gold is still struggling to acquire traction and is stuck in a narrow range. Trader interest in directional bets is being resisted by the unclear course of the Fed rate cut. A favorable risk tone and muted USD demand are factors driving the range-bound price movement.

A little increase in the AUD/USD pair is being maintained above 0.6500 after the release of mixed Chinese inflation data. As expected, China's CPI fell by 0.8% in January, although by just 0.5%. Additionally supporting the pair despite improved sentiment is a generally weaker US dollar. We anticipate Fed speak and US statistics.

Being the world's largest consumer of yellow metal, China's stimulus confidence is also benefiting the price of gold. The US Federal Reserve policymakers' recent less dovish remarks are anticipated to be taken into consideration by dealers, restricting the amount that the gold price can rise.

The psychological level of $… is the first significant resistance for the price of gold if it maintains its position above the $… demand zone. About $… is considered to be the next key supply zone for the brilliant metal.

On the downside, gold sellers should aim for a firm closure below the $… region outlined earlier. If the $… round figure gives way, there will be a test of the $… threshold farther down.

The offer made by Hamas for a truce and the release of captives detained in the Gaza Strip has been rejected by Israeli Prime Minister Benjamin Netanyahu. However, US Secretary of State Antony Blinken has raised the prospect of more talks to reach an agreement. Furthermore, a Hamas delegation headed by top official Khalil Al-Hayya is scheduled to travel to Cairo on Thursday in order to hold negotiations with Egypt and Qatar with the goal of coming to a ceasefire.

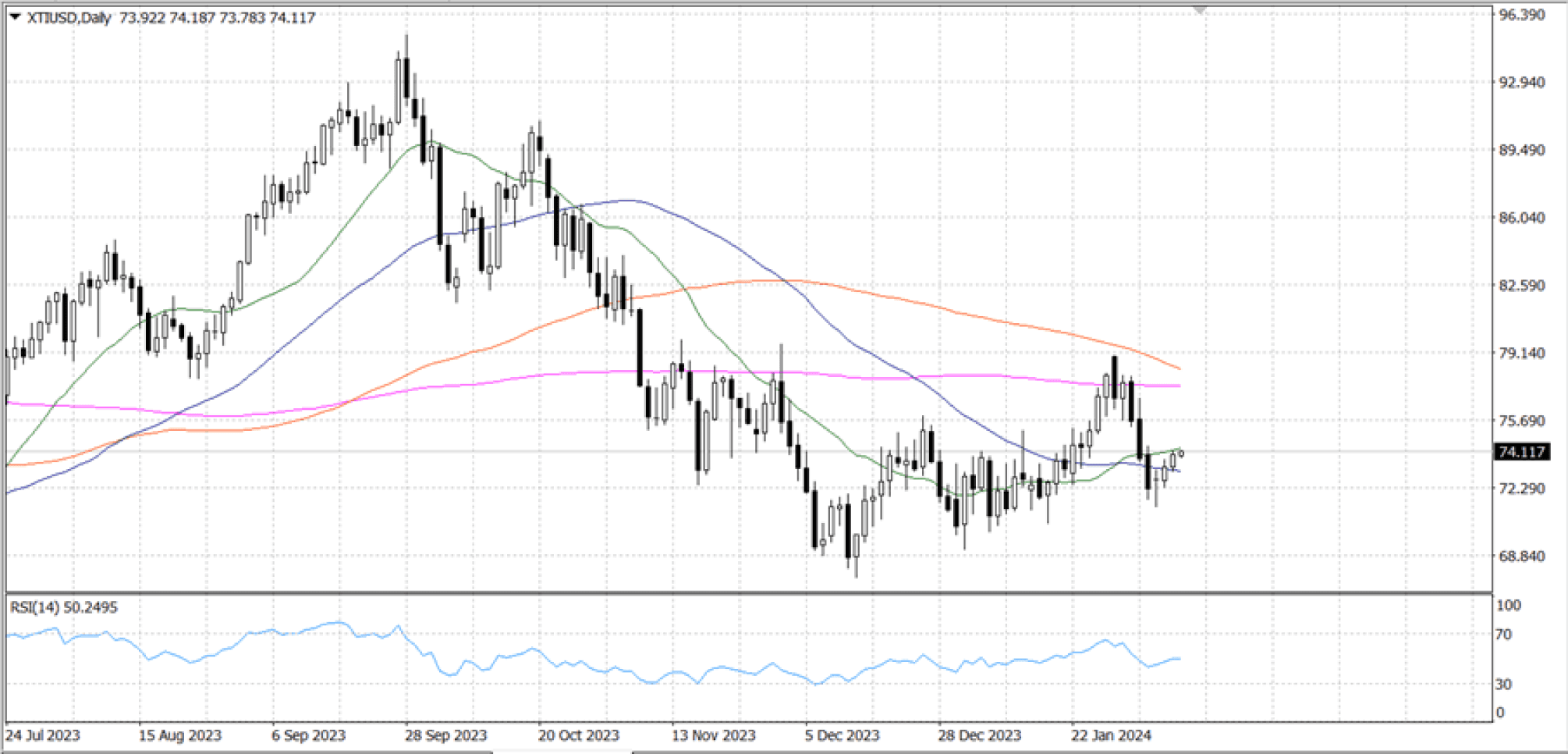

Although WTI US Crude Oil is having difficulty regaining the $… handle on Wednesday, it is still supported on the high side by barrel bids that are still rising following a near-term drop to $… last week. Around the $… handle, the price activity is still confined to the south side of the 200-HMA.

US Crude Oil is still trading in the center of a medium-term congestion range that has hindered price progress since it dropped below the 200-DMA in November. WTI is still down following a near-term rejection from the 200-DMA just below the $… handle.